Time-Series & Sector Positioning

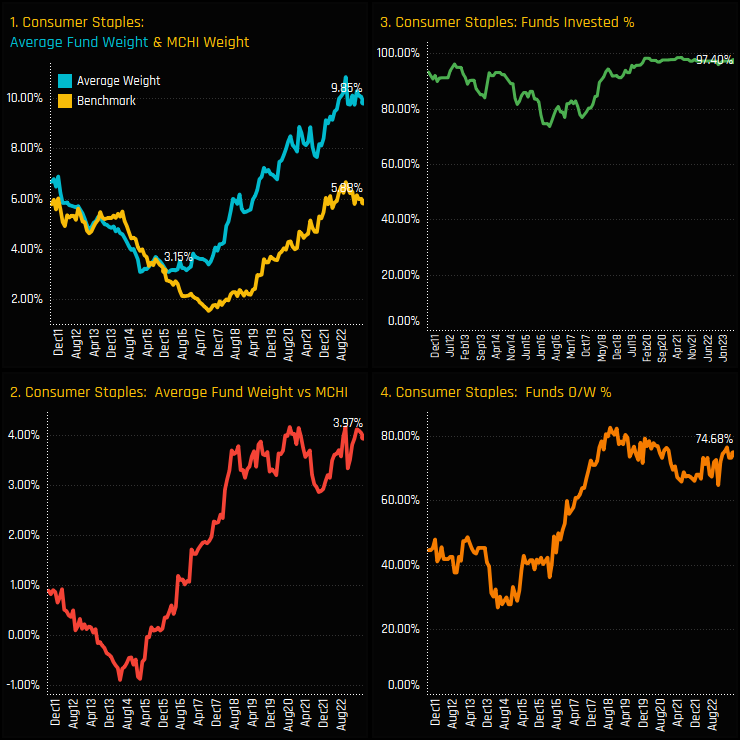

The growth in Consumer Staples exposure has been a key theme for China active managers over the last decade. Average fund weights matched the benchmark at 3.15% in late 2015, but since then there has been a growing divergence between active and passive allocations (ch1). Versus the iShares MSCI China benchmark, the active funds in our analysis are now positioned +3.97% overweight (ch2), with 74.7% of managers holding a Consumer Staples weight higher than the benchmark’s 5.88% allocation (ch4).

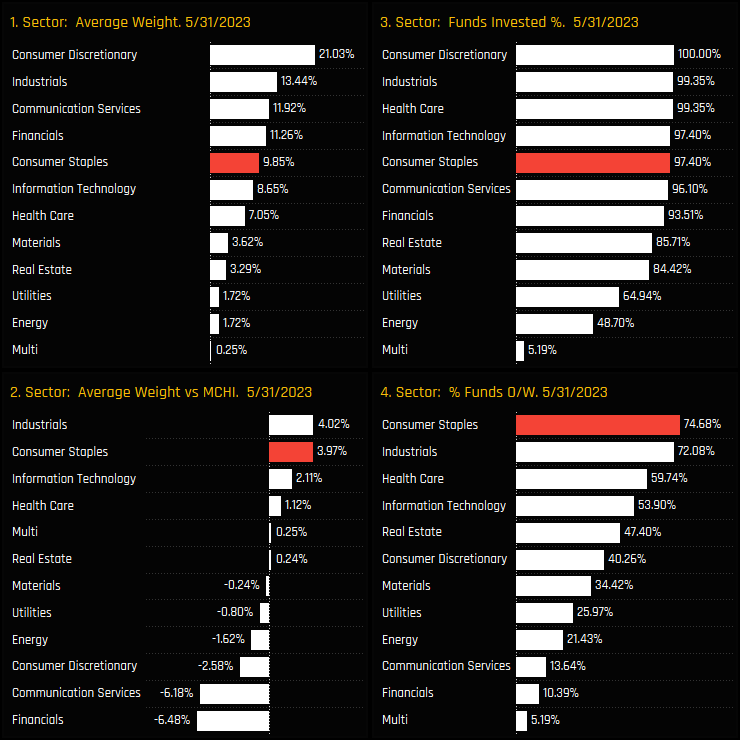

Versus sector peers, Consumer Staples are the 5th largest sector allocation behind Financials, Communication Services, Industrials and Consumer Discretionary (ch1). Versus the iShares MSCI China ETF, Consumer Staples are the 2nd largest overweight position behind Industrials (ch2), offsetting large underweights in the Financials and Communication Services sectors.

Fund Holdings & Activity

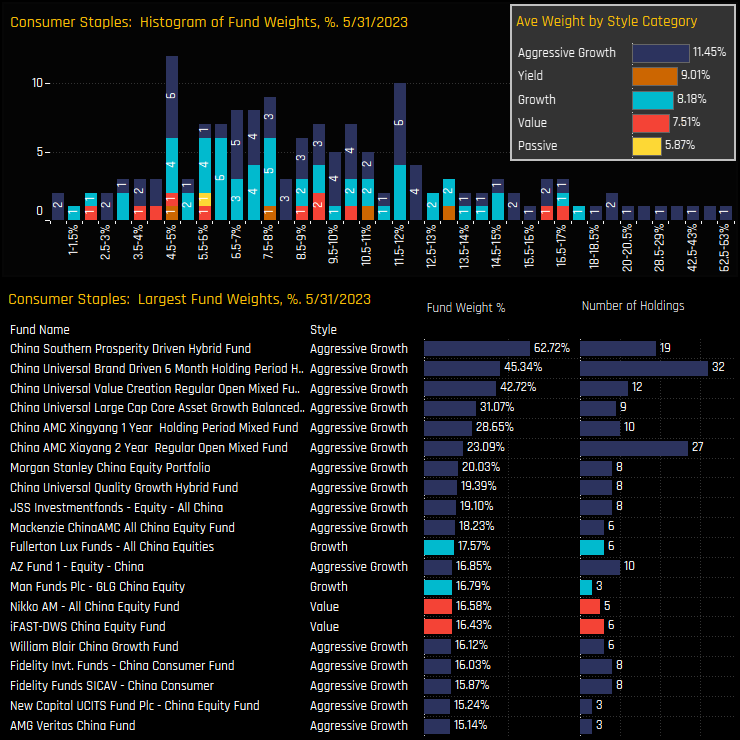

The histogram of fund level holdings in the top chart shows the bulk of Consumer Staples weights at between 4.5% and 12%. The long tail to the upside is dominated by domestic China strategies at the Aggressive Growth end of the spectrum, led by China Southern Prosperity (62.7%) and China Universal Brand Driven (45.3%). All Style groups are overweight the iShares MSCI China ETF, on average

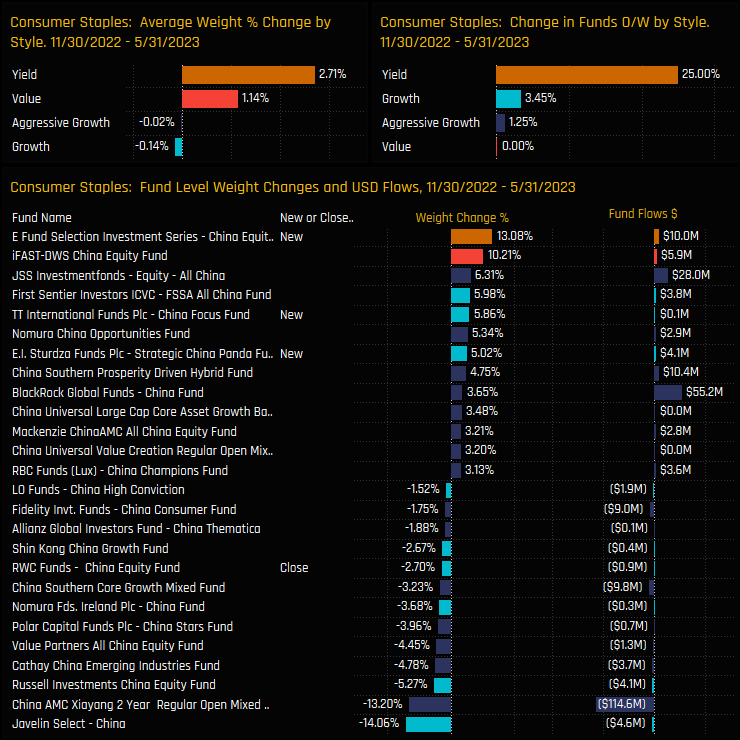

Fund level activity over the last 6-months has been skewed to the buyside, with 3 opening positions cancelling out 2 closures, led by E Fund China Equity Dividend’s 13.1% new holding. With only 4 Yield funds in our China analysis, this shows as a 25% increase in the percentage of Yield funds moving to overweight, though a further +3.45% of Growth and +1.25% of Aggressive Growth funds made the same move.

Stock Holdings & Activity

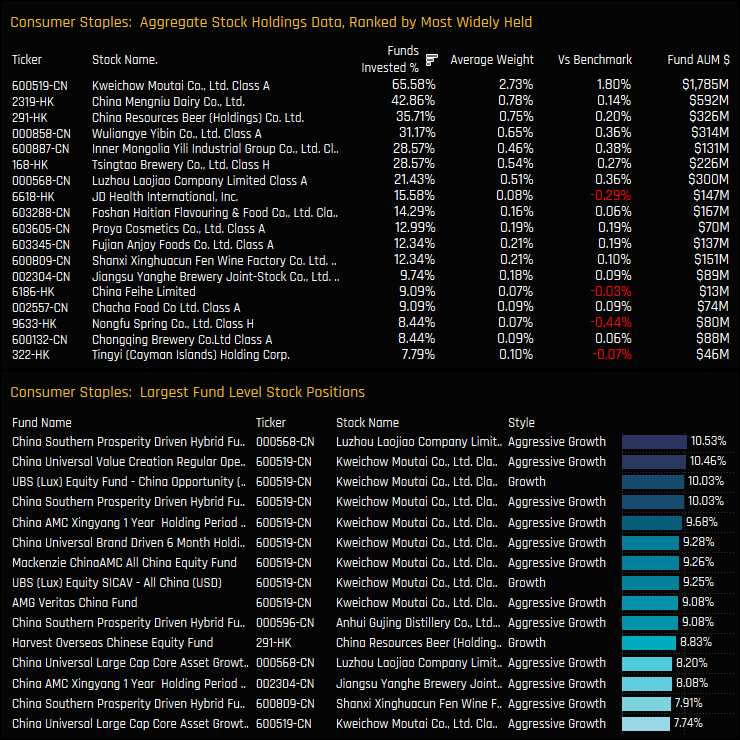

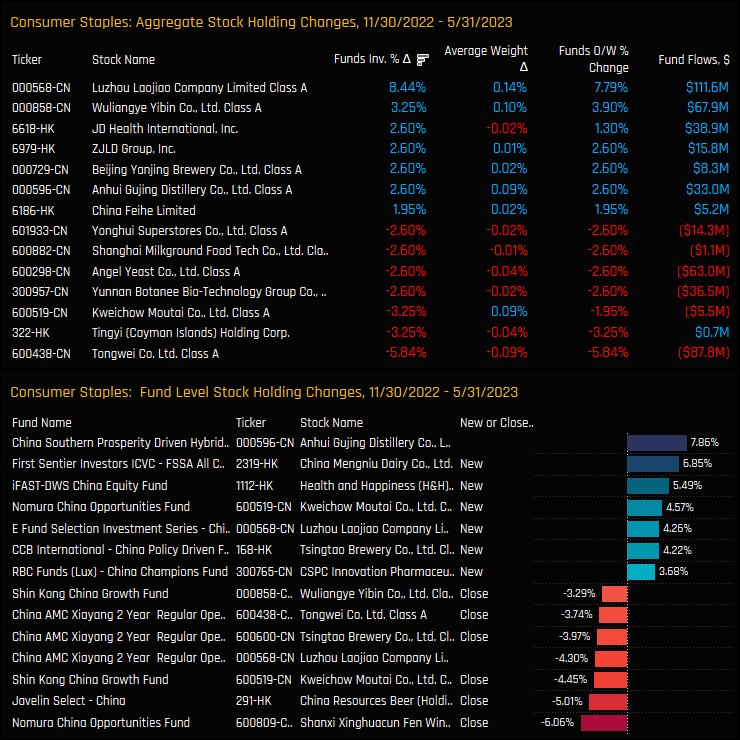

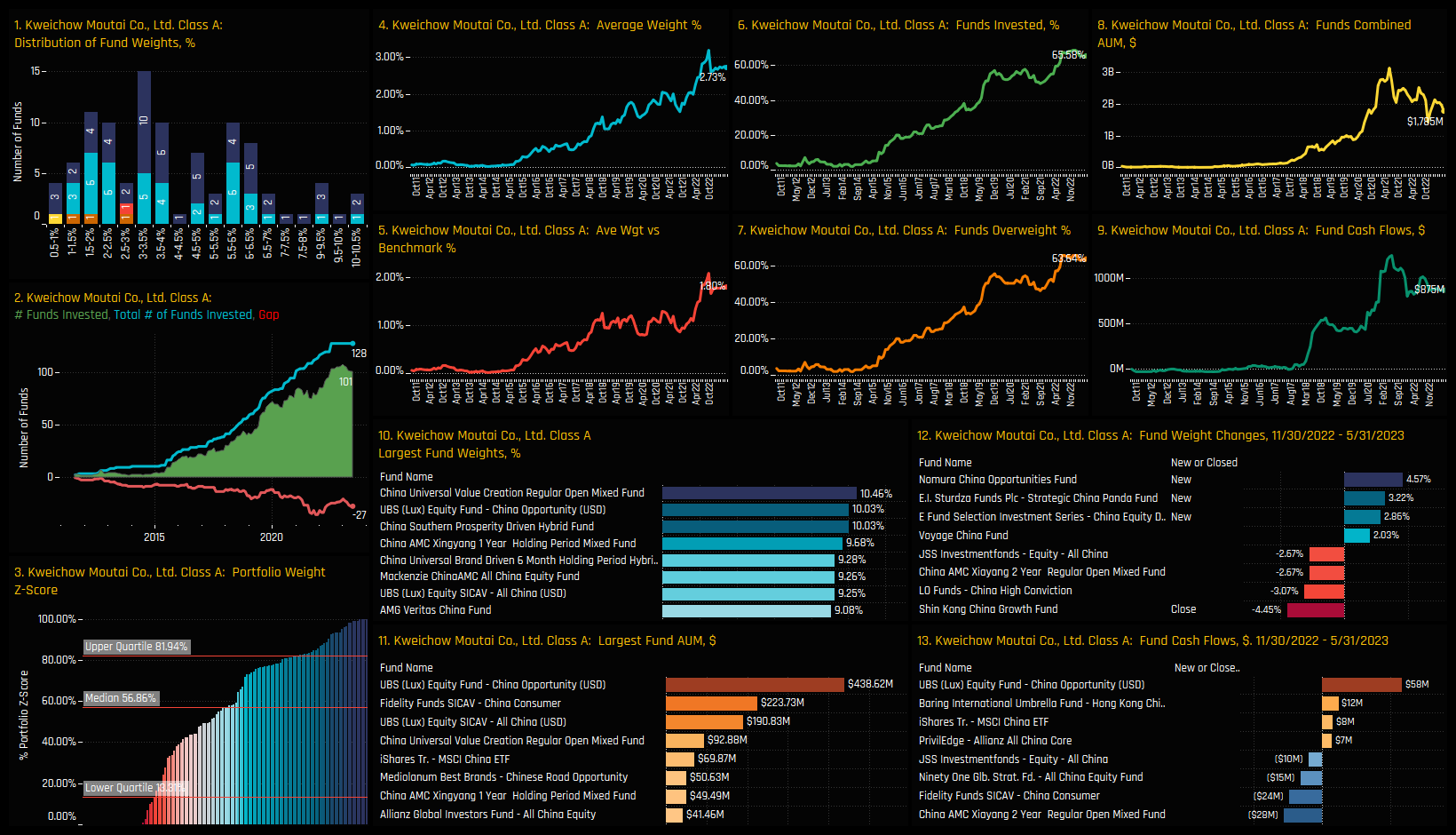

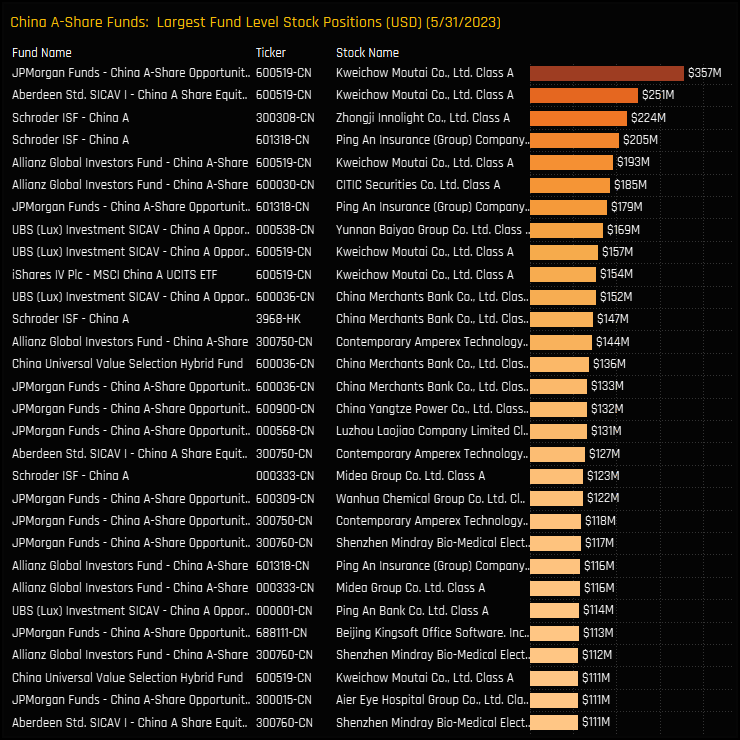

Stock holdings in the Consumer Staples sector are widespread, with 7 companies held by more than 20% of the funds in our analysis. The most widely held is Kweichow Moutai Co, a stock owned by 65.6% of funds at an average weight of 2.73%, or overweight the benchmark by +1.80%. The list of large stock level positions in the bottom chart below is dominated by Kweichow Moutai, with 3 funds holding a >10% position and a further 6 above 9%. Kweichow is the high conviction holding within the sector.

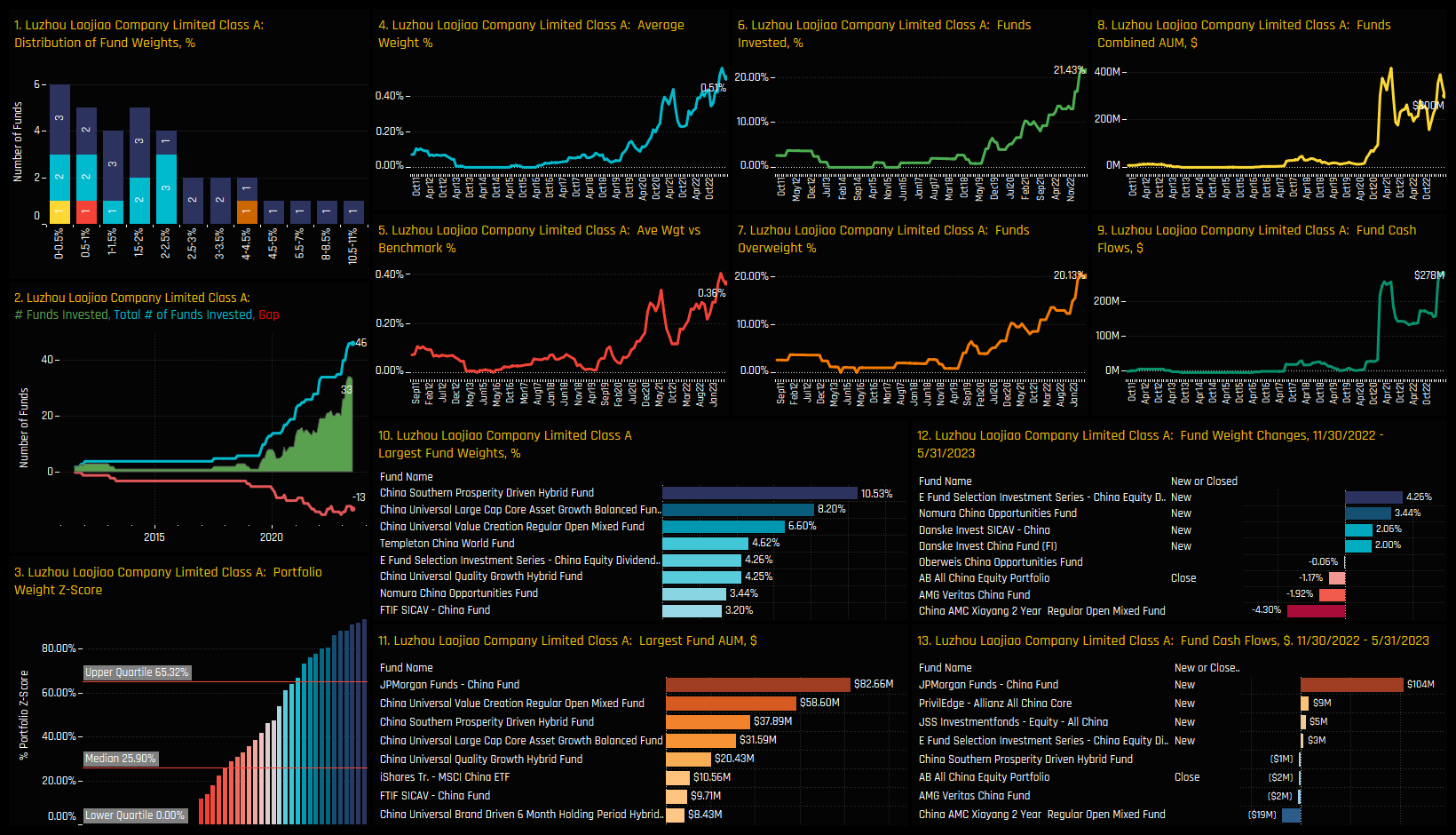

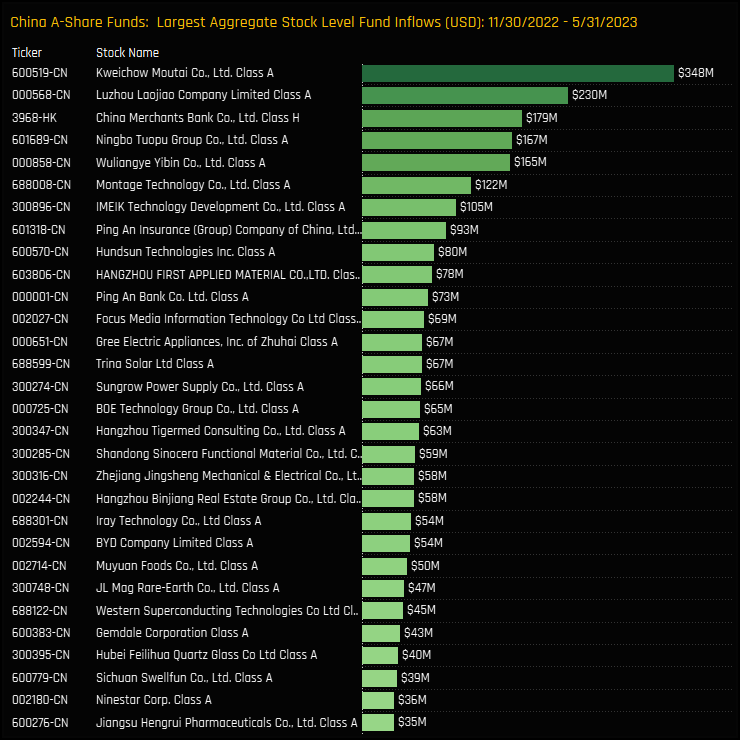

Aggregate stock level position changes over the last 6-months are shown in the top chart below. There has been a high degree of rotation within the sector, with a net +8.4% of funds buying in to Luzhou Laojiao Company and +3.25% in to Wuliangye Yibin Co. Against this, a net -5.84% of funds closed exposure to Tongwei Co and -3.25% closed Tingyi Holding Corp and Kweichow Moutai positions. The bottom chart highlights the largest individual fund level changes over the same period, with China Southern Prosperity Driven Hybrid Fund’s +7.86% weight increase in Anhui Gujing Distillery among the larger moves.

Conclusions & Links

The majority of active MSCI China funds are positioned for the outperformance of the Consumer Staples sector. Overweights are near record levels at +3.97% above benchmark, underpinned by strong ownership in stocks such as Kweichow Moutai and Mengniu Dairy.

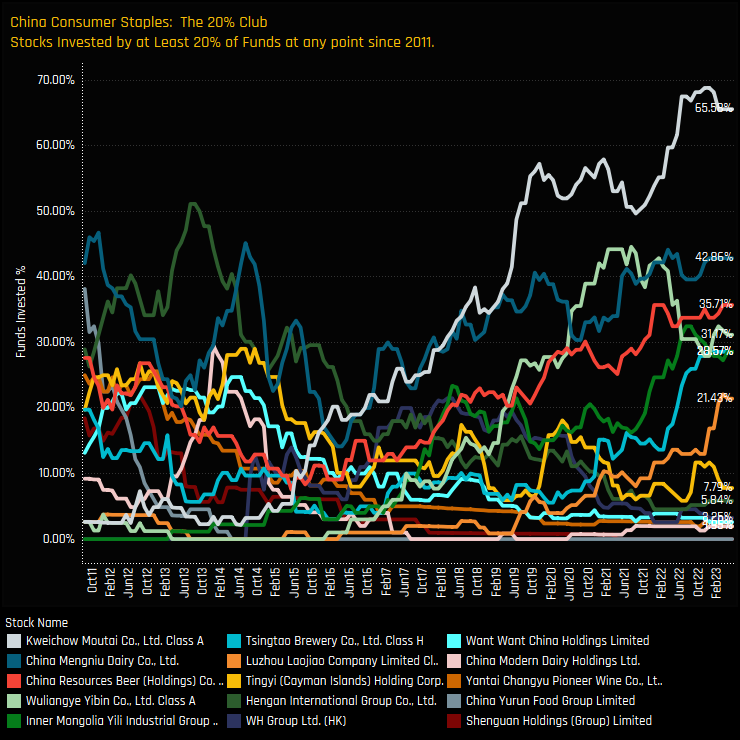

In fact, today’s 7 most widely held stocks in the Consumer Staples sector join a prized group of just 15 companies that have ever been owned by more than 20% of funds at any one time. The time-series of funds invested for these stocks is shown in the chart opposite. Dubbed the 20% Club, 8 of these stocks have since left, with Luzhou Laojiao Company the most recent entrant. The remaining 6 stocks are Kweichow Moutai, China Mengniu Dairy, China Resources Beer, Wuliangye Yibin, Inner Mongolia Yibin and Tsingtao Brewery.

The 20% club accounts for 65% of the total Consumer Staples allocation and 88.4% of the total overweight. Though 106 stocks have found investment in the Consumer Staples sector today, in the mind of the active China investor at least, 7 of these are best positioned to capture growth in China’s vast consumer market.

Click on the link below for an extended data report on China Consumer Staples positioning. Scroll down for stock profiles on Kweichow Moutai, China Mengniu Dairy, China Resources Beer and Luzhou Laojiao Company.

Stock Profile: Kweichow Moutai

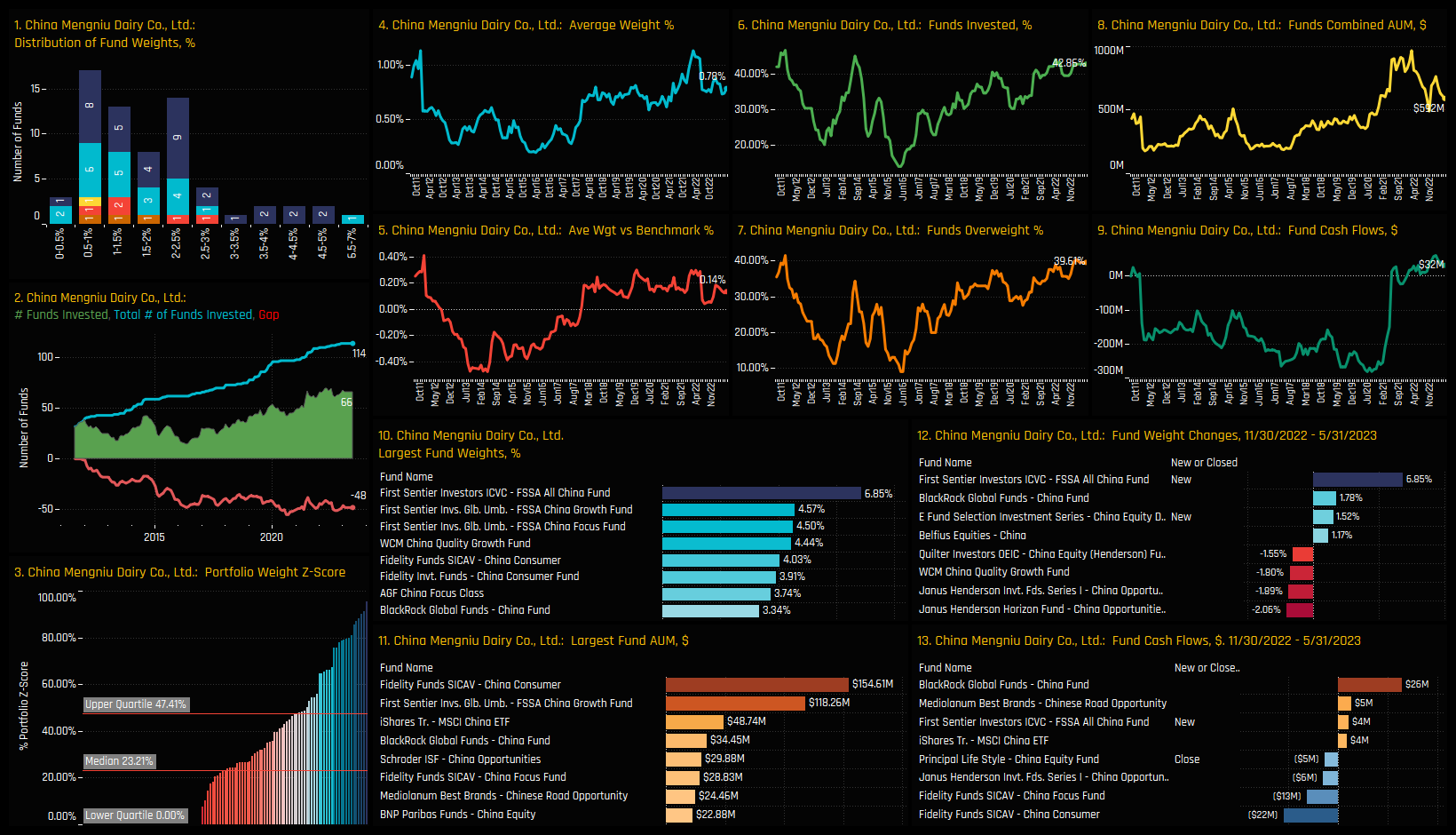

Stock Profile: China Mengniu Dairy

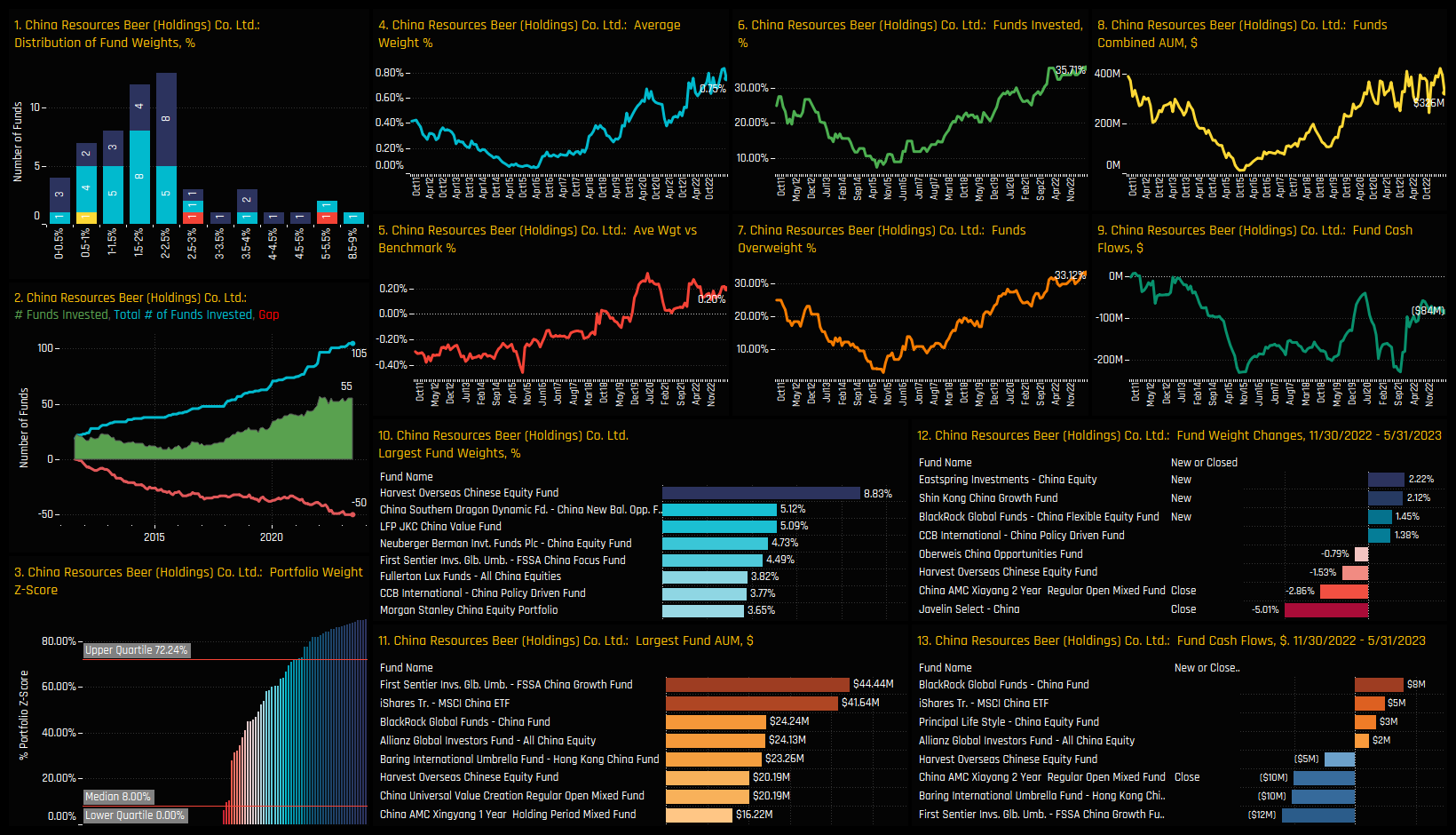

Stock Profile: China Resources Beer

Stock Profile: Luzhou Laojiao Company

Time-Series Analysis & Stock Activity

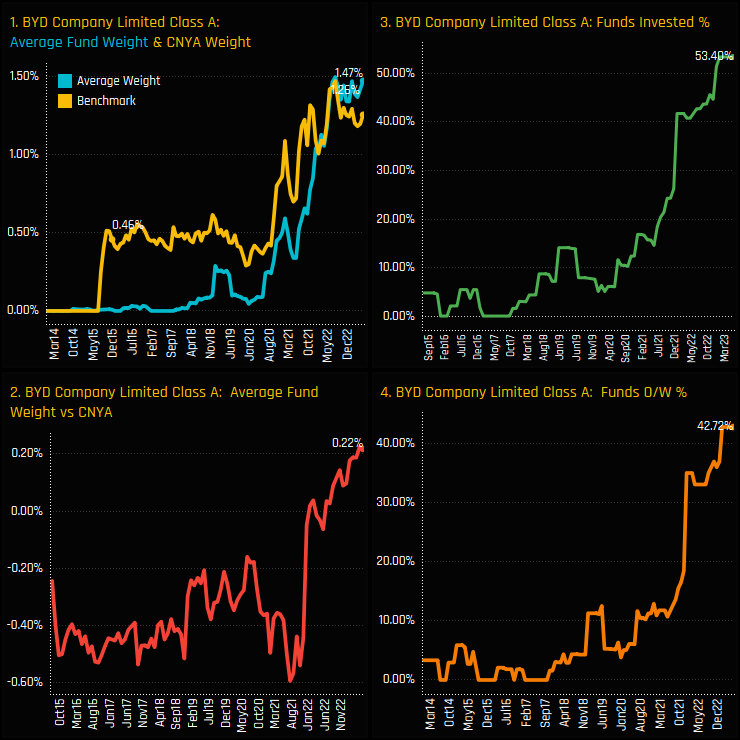

Ownership in BYD Company Limited A Shares has soared to record levels. A consistently avoided stock among active China A-Share investors before 2020, interest started to gather momentum towards the early part of 2020. Chart 3 below shows the percentage of A-Share funds invested in BYD over time, with a sharp jump higher from below 20% in mid-2021 to record levels of 53.4% today. This aggressive ownership increase has resulted in the collapsing of a sizeable underweight position that ran from 2015 – 2021. With nearly half of the A-Share funds in our analysis now positioned overweight, sentiment has never been stronger.

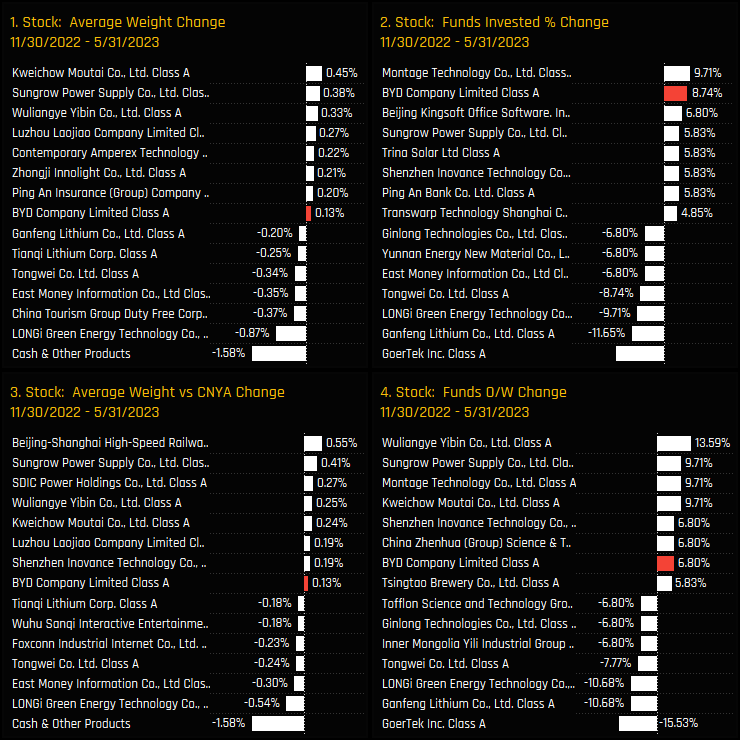

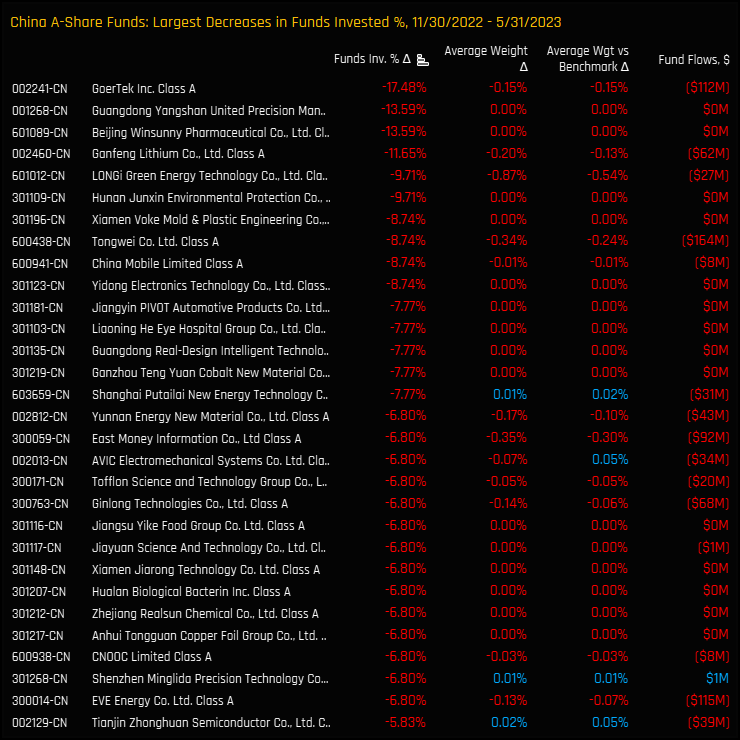

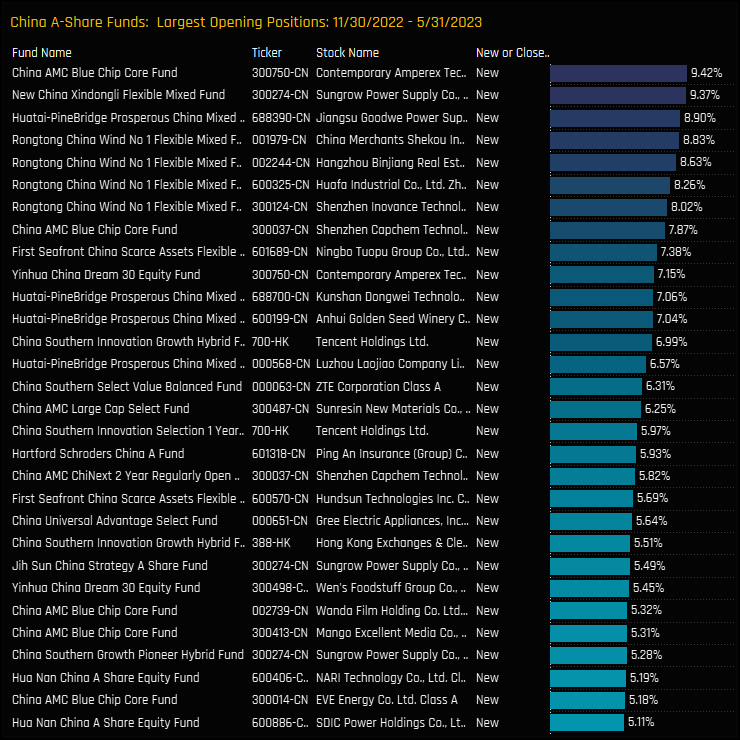

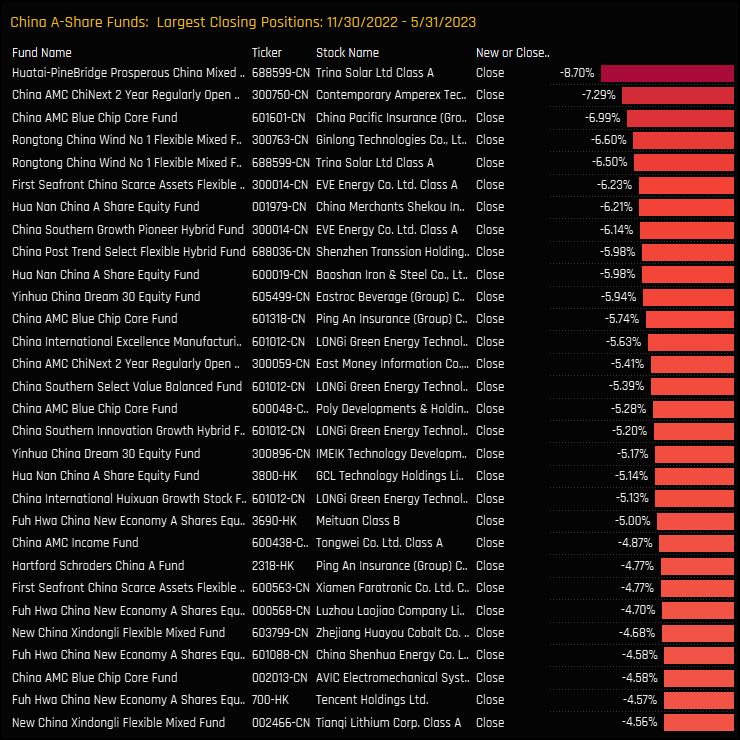

Over the last 6-months, BYD has maintained this positive momentum and has faired well versus China A-Share peers across all sectors, as highlighted in the charts below. All 4 measures of fund ownership moved higher over the period, with the rise in the percentage of funds invested of +8.74% the second highest across the A-Share universe. Montage Technology Co captured the largest increase in ownership, whilst A-Share managers closed positions in GoerTek Inc Class A, Ganfeng Lithium Co and LONGi Green Energy Technology.

Fund Activity & Latest Fund Holdings

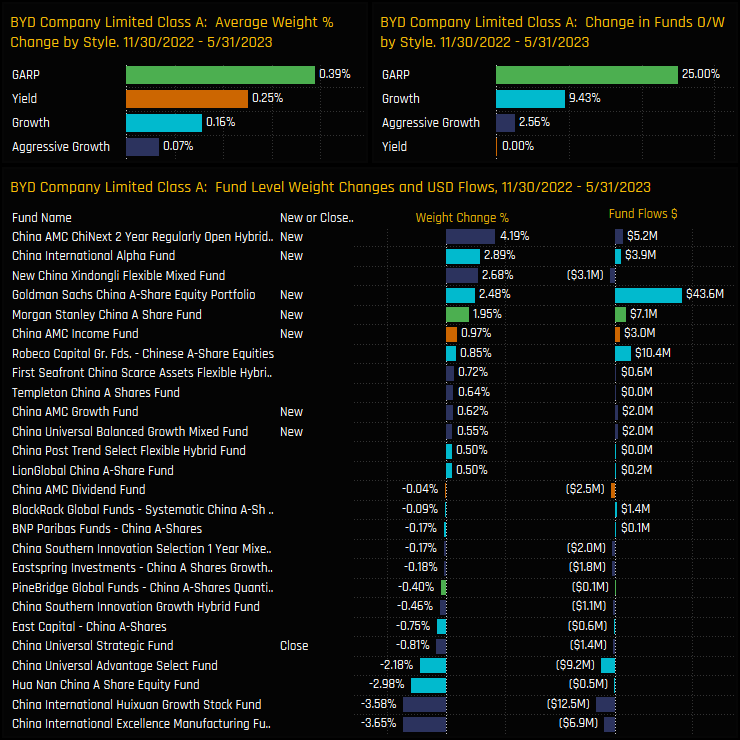

The below charts show the Style breakdown and fund level activity driving this rotation. On a Style basis, GARP and Yield funds saw ownership rise the most within their respective universes, though Growth and Aggressive Growth funds increased exposure the most in absolute terms. On a fund level, between 11/30/2022 and 05/31/2023 a further 9 funds opened new positions in BYD, led by China AMC (+4.19%) and China International Alpha (+2.89%).

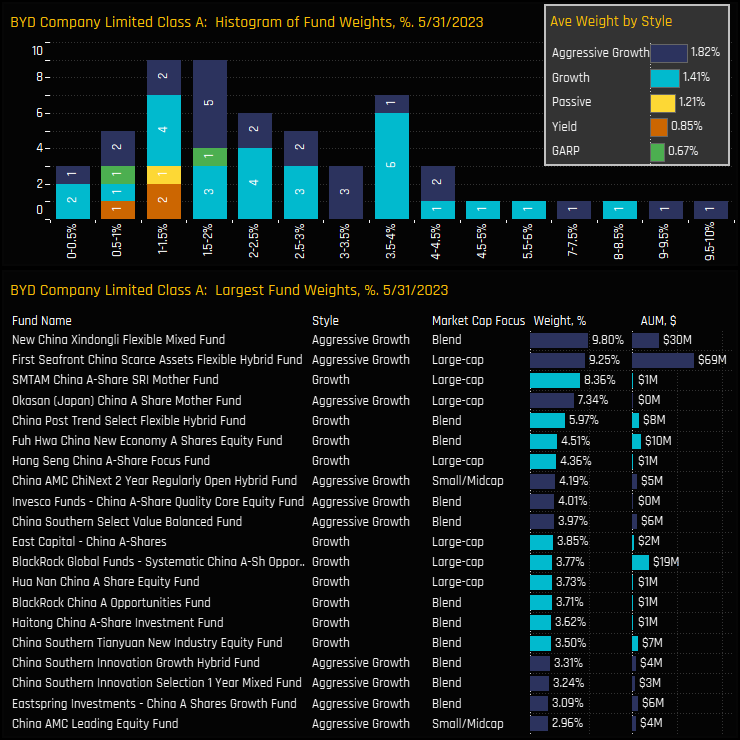

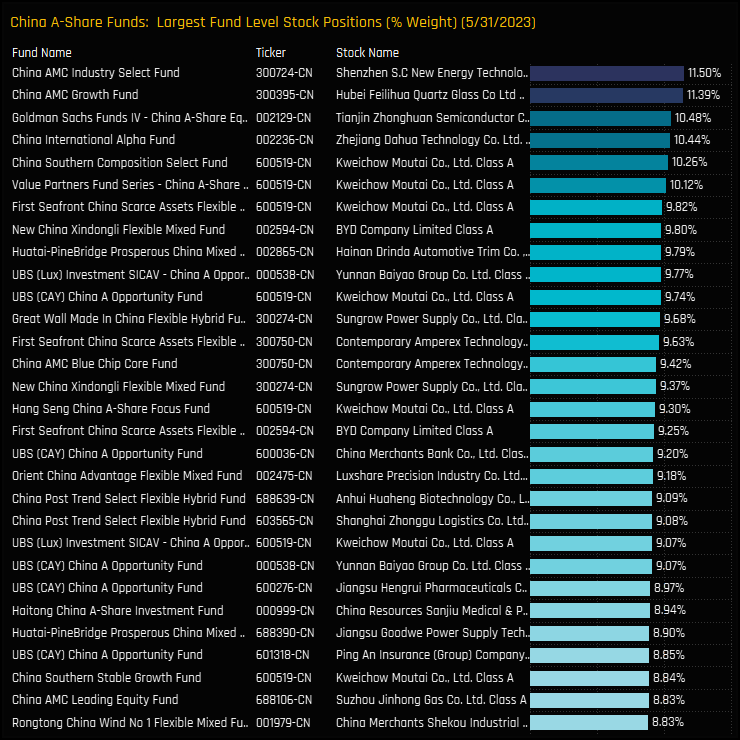

The histogram of fund weights in BYD is shown in the top chart below, and highlights the majority of holders at between the 1% and 4% level. The cluster of 6 funds above 5% is led by New China Xindongi Flexible (9.8%) and First Seafront China Scarce Assets (9.25%) and highlights how BYD has risen to the forefront of selected strategies. Growth and Aggressive Growth funds are the lead allocators, with both positioned ahead of the iShares MSCI China A-Shares benchmark, on average.

Latest Stock Holdings & BYD's Global Appeal

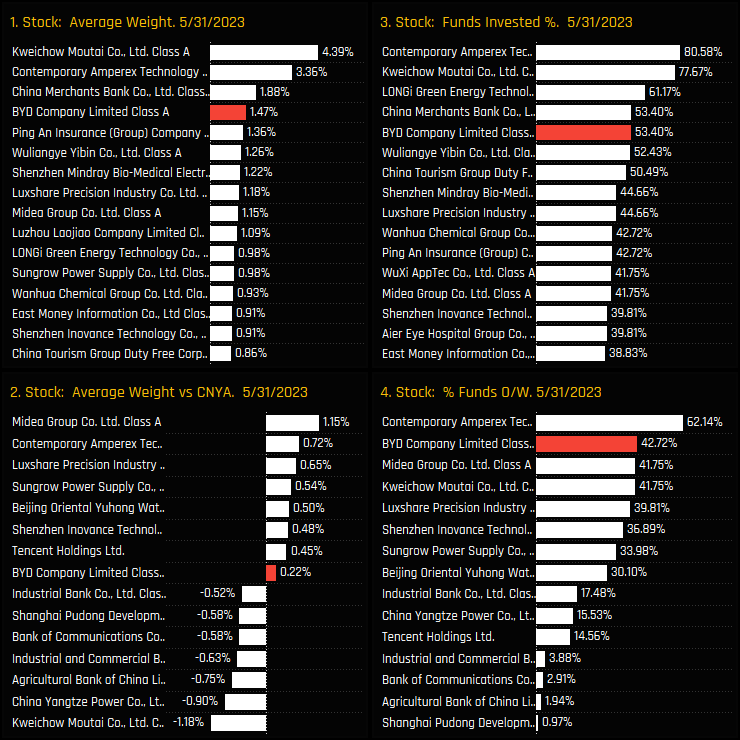

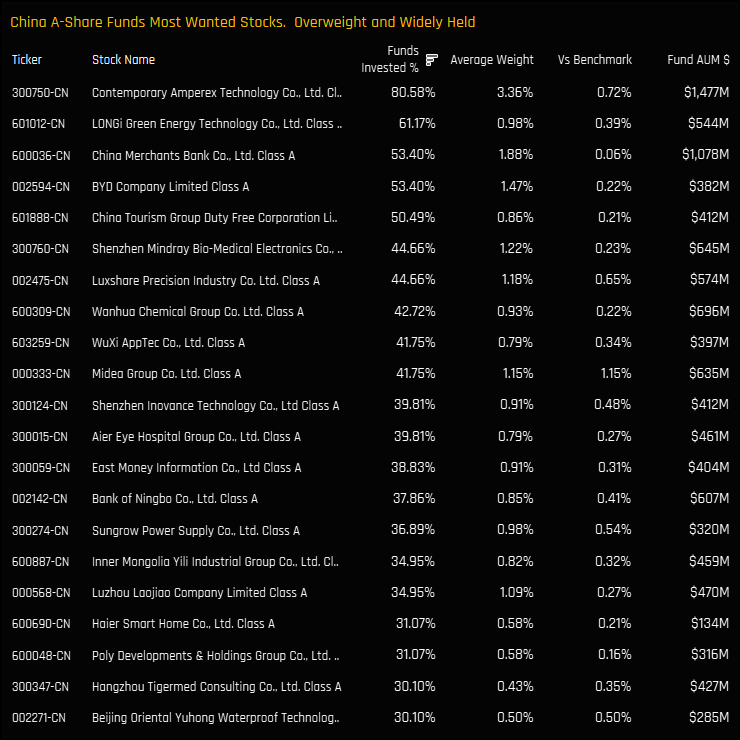

The charts below show the latest ownership statistics for all stocks in the A-Share universe. BYD has risen up the ranks to become the 4th most widely held and 4th largest weight in the A-Share stock universe. Versus the benchmark, only Contemporary Amperex Technology is held overweight by more funds.

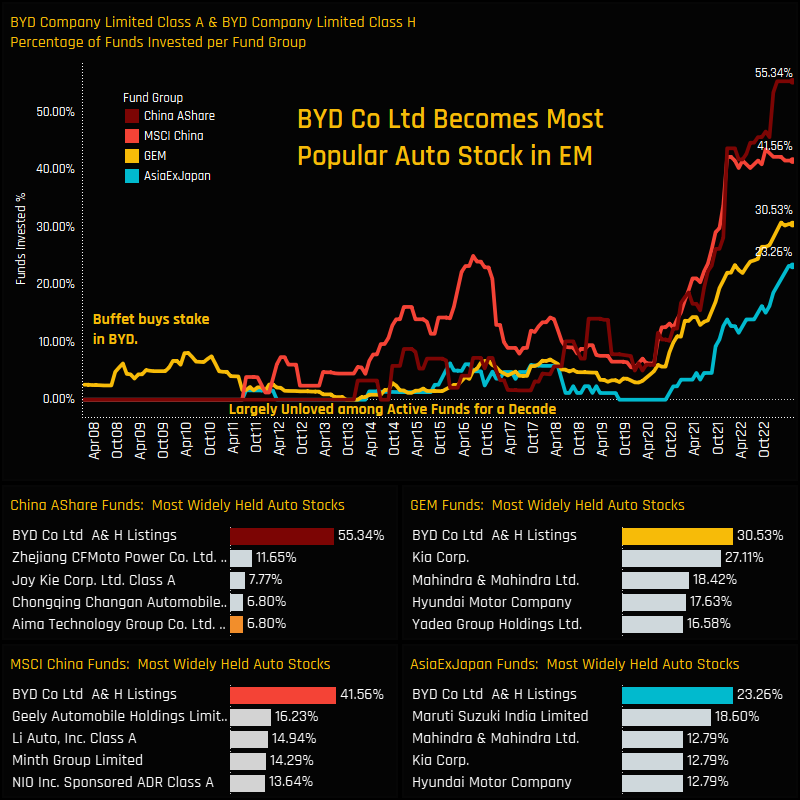

Finally, we understand that those of you who have a subscription to our EM and Asia Ex-Japan research may be experiencing a sense of deja-vu. The fact is, BYD is flashing green across these fund universes too, in addition to our MSCI China and China A-Share fund groups. The charts below show record levels of investment across all 4 universes in BYD, with the stock even overtaking the industry heavyweights of Kia Motors and Maruti Suzuki to become the most widely owned Auto stock in EM right now.

Links

Click on the link opposite for the full data report on BYD Co positioning among active China A-Share Funds.

For more analysis, data or information on active investor positioning in your market, please get in touch with me on steven.holden@copleyfundresearch.com

Related Posts

- Steve Holden

- March 13, 2025

Xi’s Champions: A Closer Look at Fund Positioning

Global, GEM, Asia Ex-Japan, China Active Equity Xi’s Champions: A Closer Look at Fund Pos ..

- Steve Holden

- March 28, 2024

MSCI China Funds: Stock Radar

125 MSCI China active equity funds, AUM $38bn MSCI China Funds: Stock Radar Summary In this rep ..

- Steve Holden

- October 15, 2024

China Funds: Performance & Attribution Review, Q3 2024

143 MSCI China Equity funds, AUM $38bn MSCI China Funds: Performance & Attribution Review, ..