119 Active MSCI China Funds, AUM $60bn.

China Communication Services

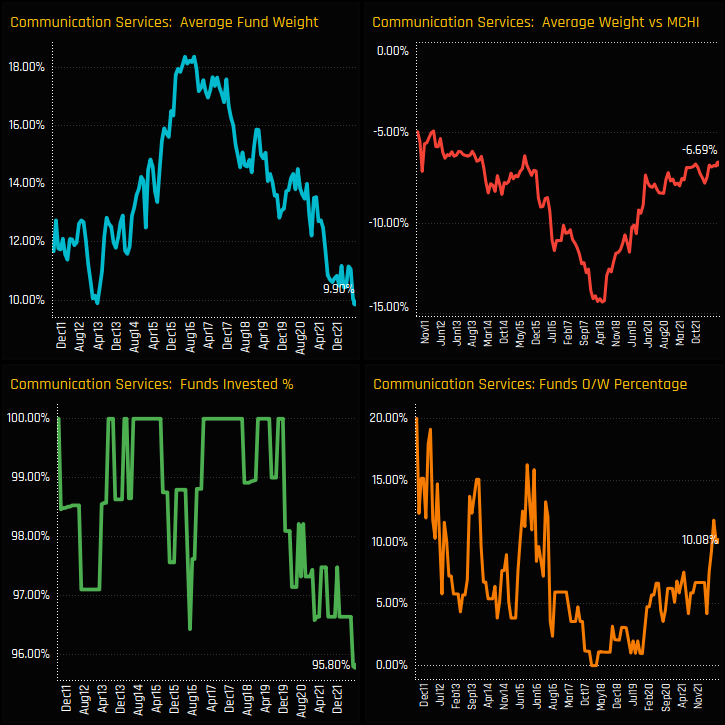

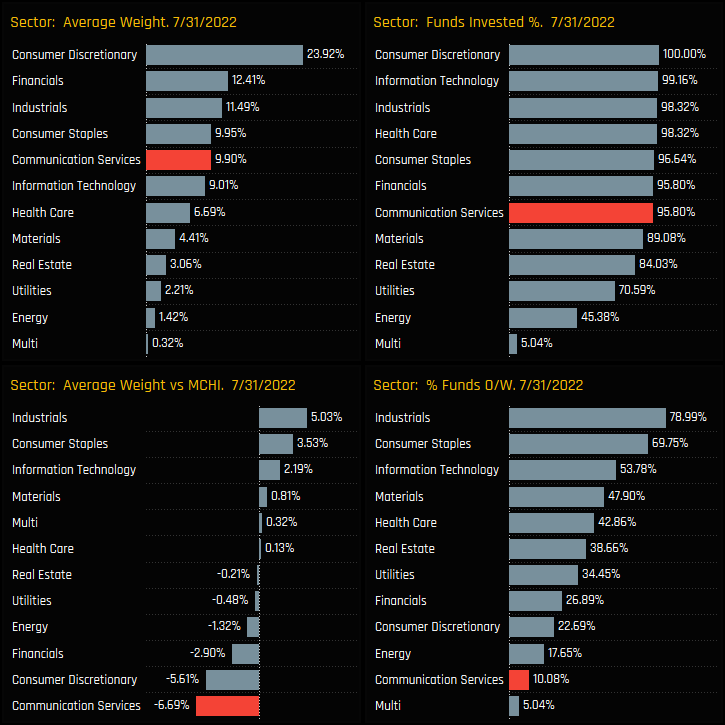

Portfolio weights in the Communication Services sector have hit their lowest levels on record, declining from a high of over 18% in mid-2015 to just 9.90% today. In this analysis. we look at positioning in the communication services sector in detail, highlighting the funds and stocks that make up exposure in the sector.

Time-Series & Sector Positioning

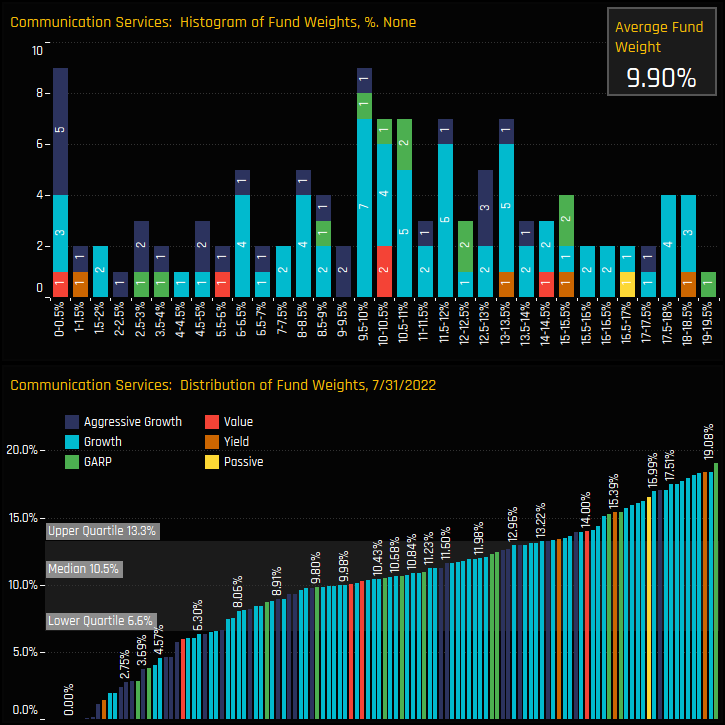

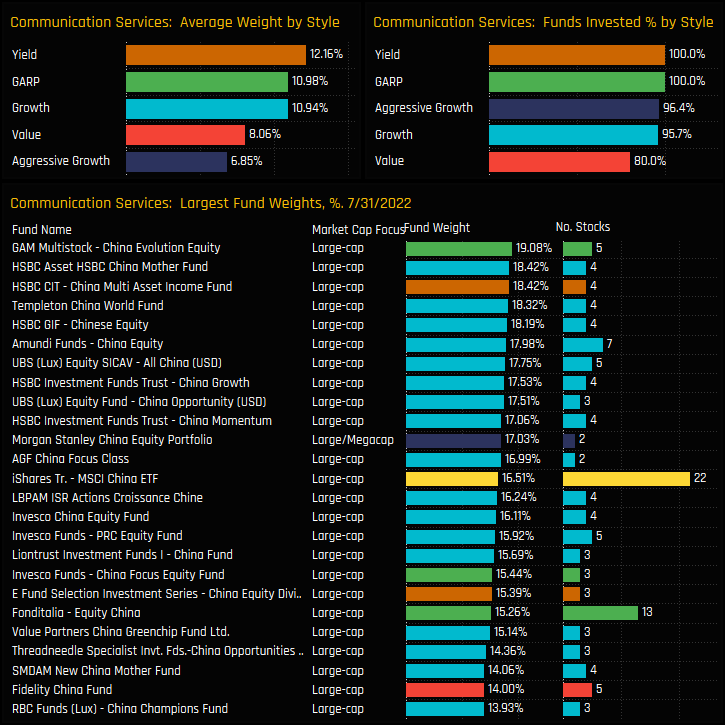

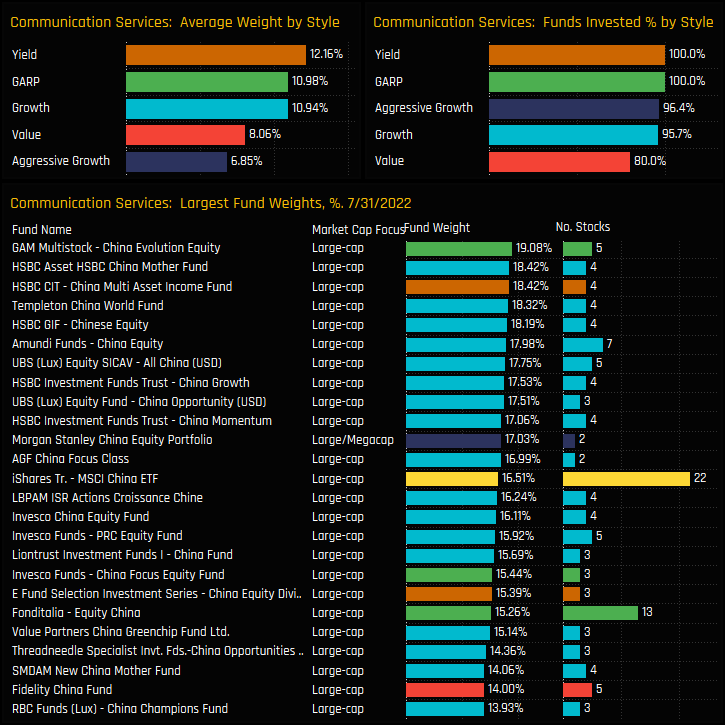

Fund Holdings & Style

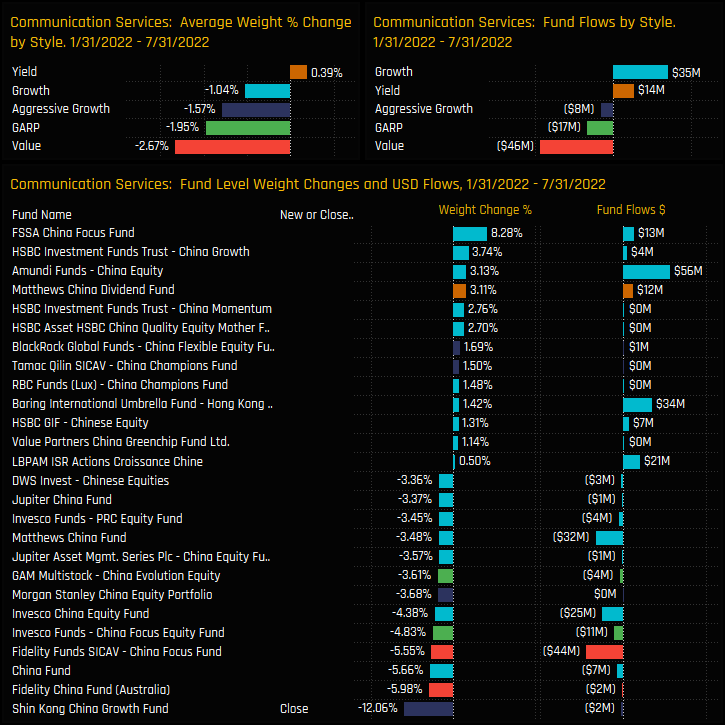

Fund Activity & Style Trends

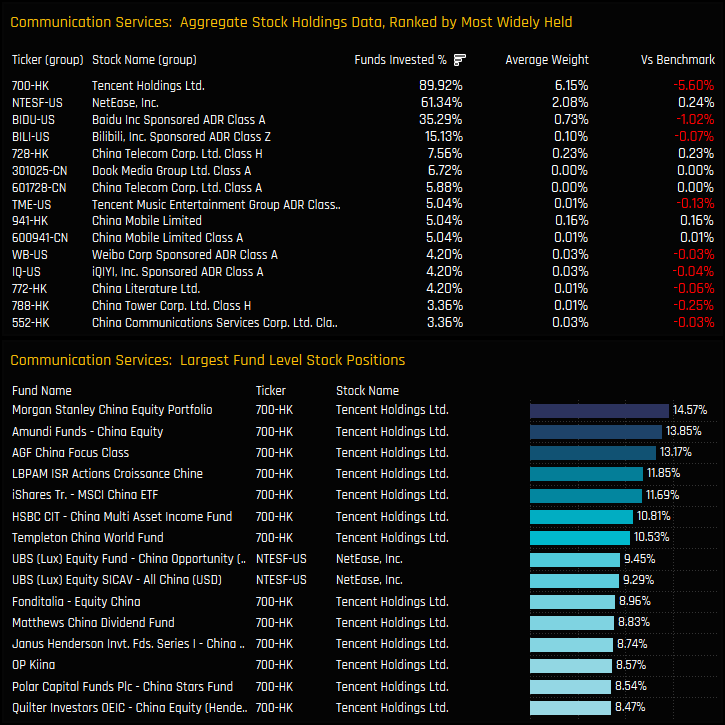

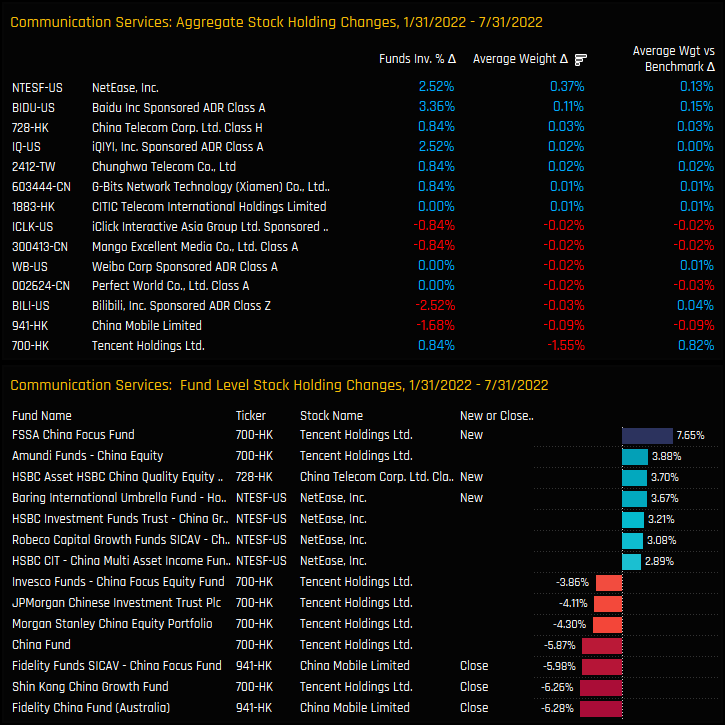

Stock Holdings & Activity

Conclusions

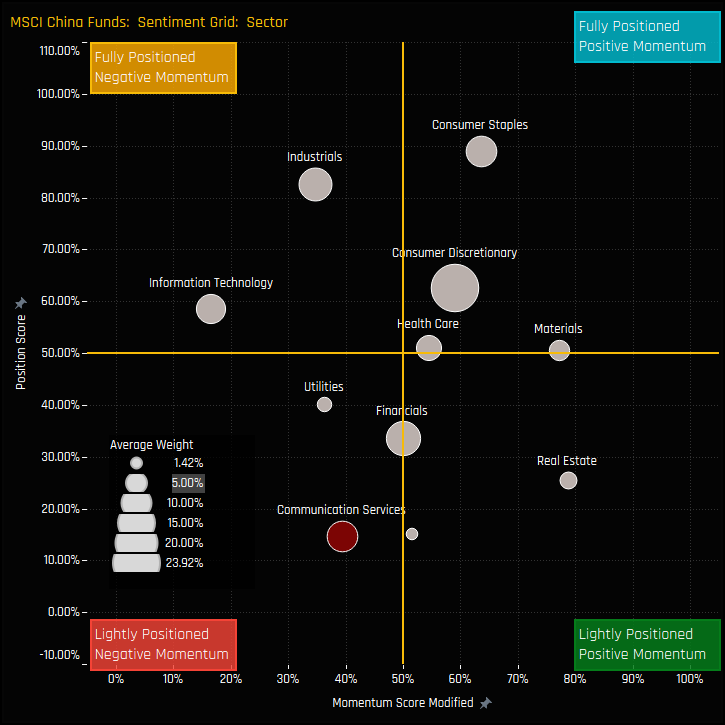

Sentiment in the Communication Services sector is close to an all-time low. The chart to the right shows where current positioning in each China sector sits versus history going back to 2011 on a scale of 0-100% (y-axis), against a measure of fund activity for each sector between 01/31/2022 and 07/31/2022 (x-axis). Positioning is the lowest of all sectors and momentum is what we might call apathetic.

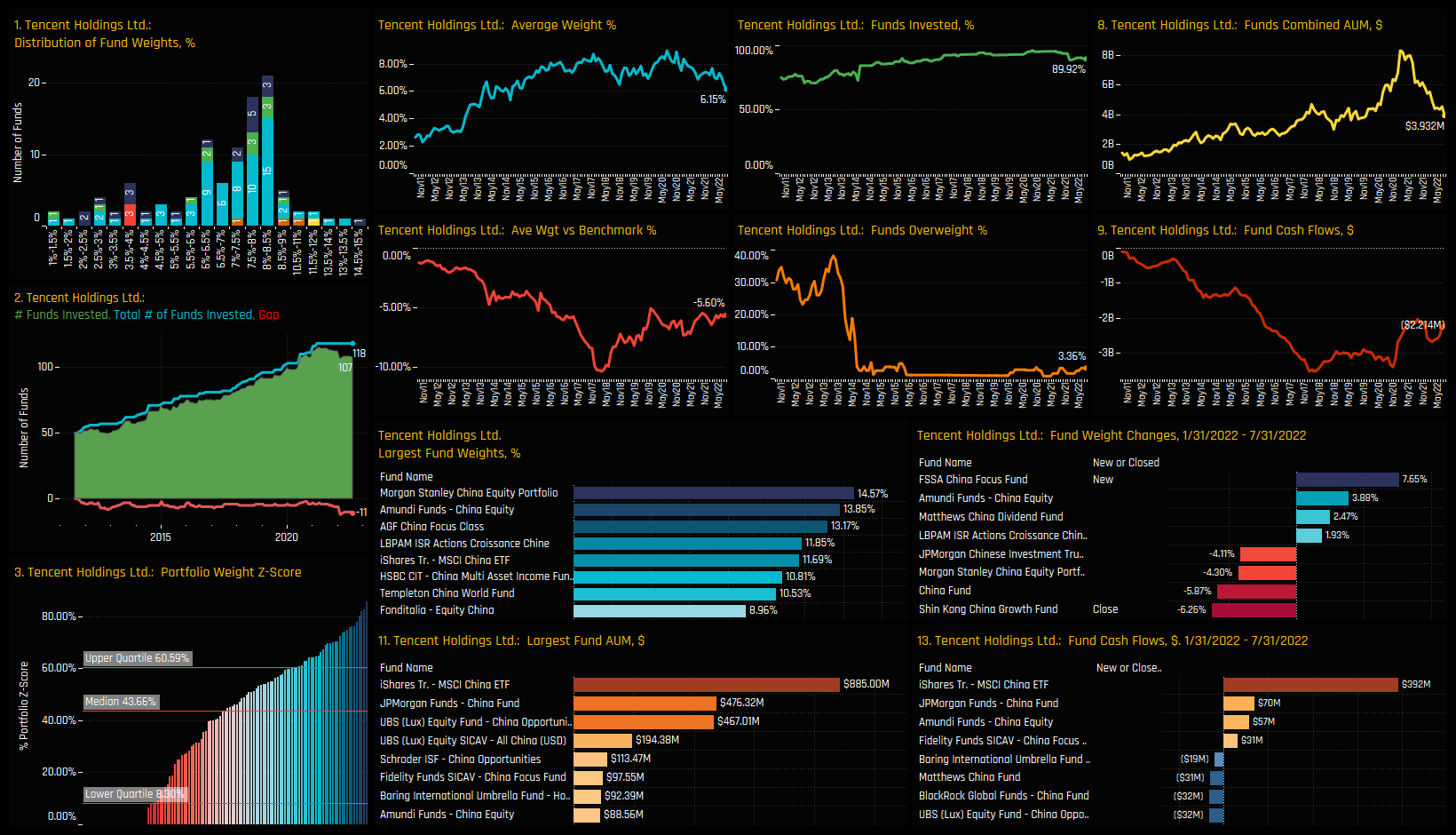

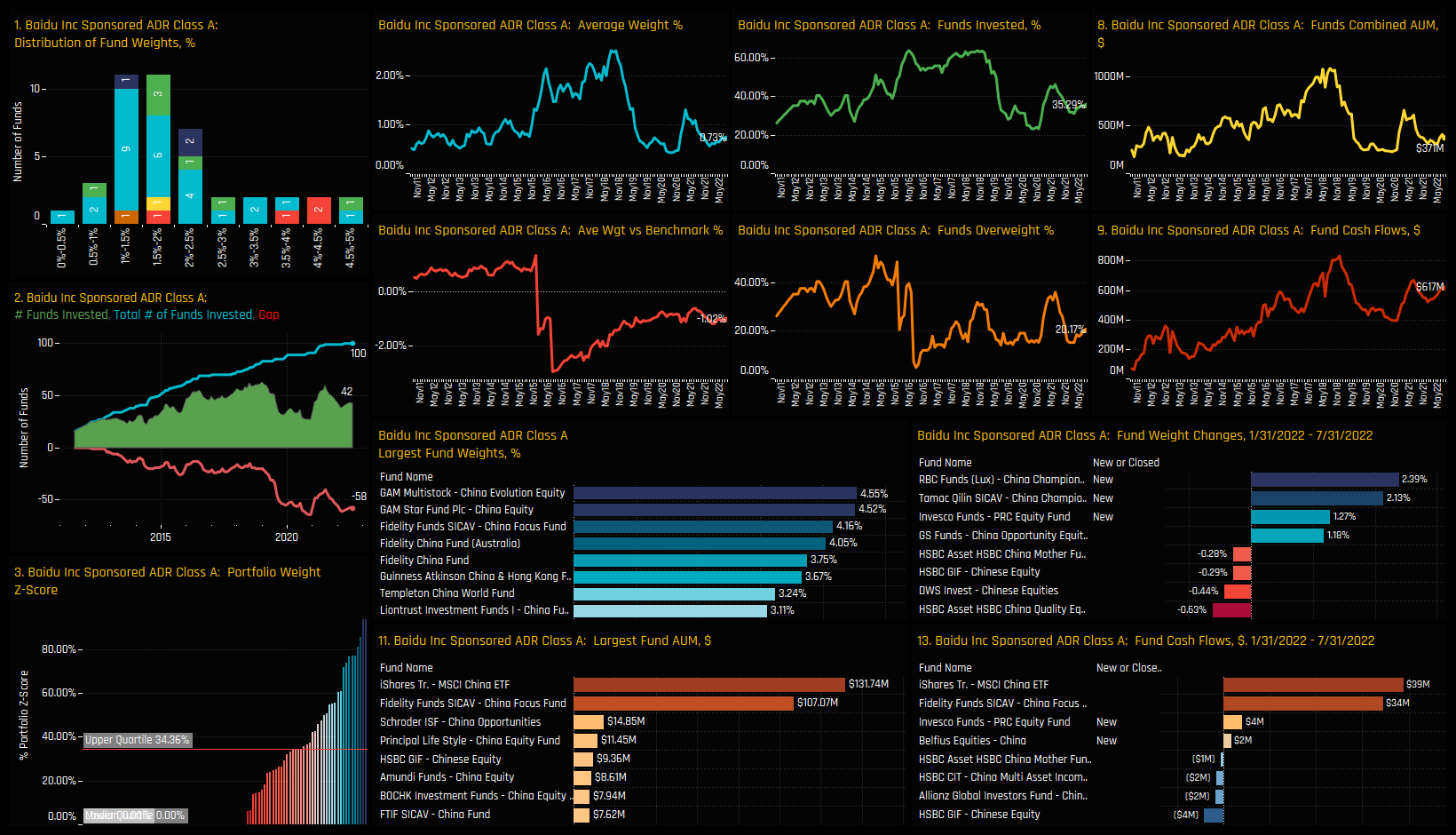

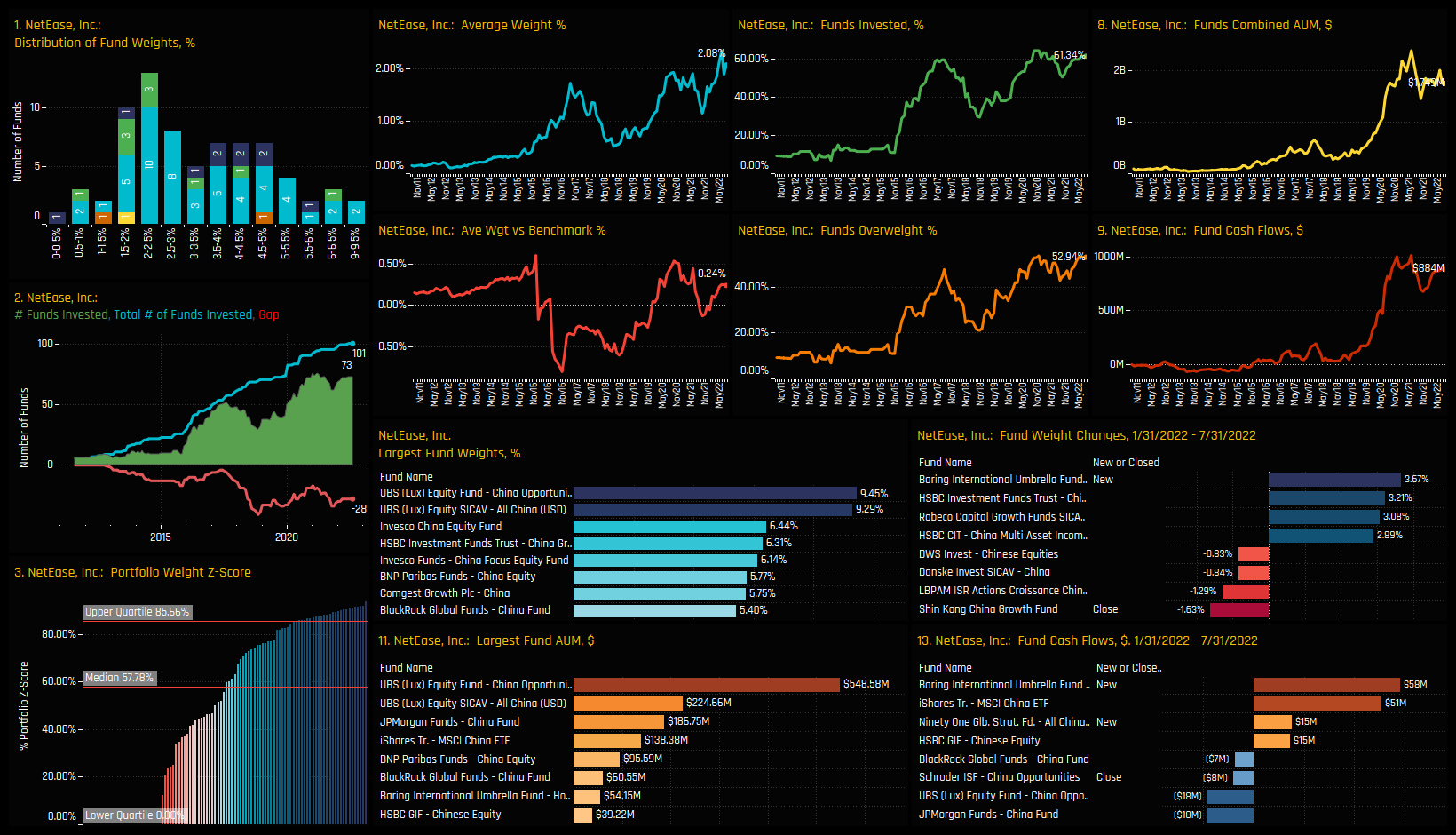

The fact that active China funds are sticking with Tencent through this period of underperformance is encouraging, in addition to the increased ownership levels in key holdings Netease Inc and Baidu Inc. Rather than an outright exodus, it feels like active China managers are riding out the storm.

See below for more ownership information on Tencent, Baidu and NetEase. Please click on the link below for the extended report on Communication Services exposure among active MSCI China funds.

Click on the link below for the latest data report on Communication Services positioning among active China funds.

Stock Profile: Tencent Holdings Ltd

Stock Profile: Baidu Inc

Stock Profile: Netease Inc

For more analysis, data or information on active investor positioning in your market, please get in touch with me on steven.holden@copleyfundresearch.com

Related Posts

- Steve Holden

- August 16, 2023

China Fund Positioning Analysis, August 2023

254 China Equity Funds, AUM $100bn China Fund Positioning Analysis, August 2023 In this issue: ..

- Steve Holden

- August 10, 2022

China A-Shares: Health Care Fall

115 Active China A-Share Funds, AUM $63bn. China Health Care Health Care weights among China A- ..

- Steve Holden

- January 12, 2023

China A-Share Funds: 2022 Performance & Attribution Report

111 Active China A-Share Funds, AUM $55bn. 2022 Performance & Attribution Report In this re ..