115 Active China A-Share Funds, AUM $63bn.

China Health Care

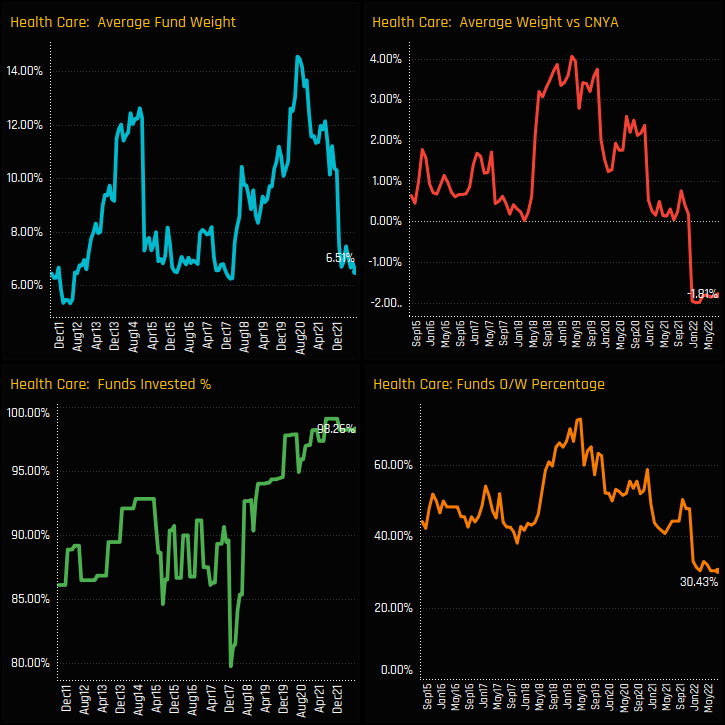

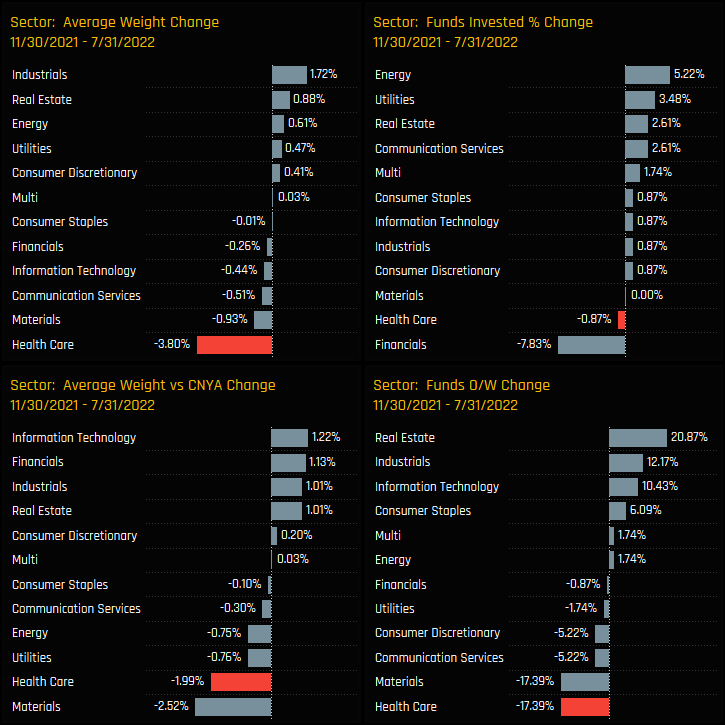

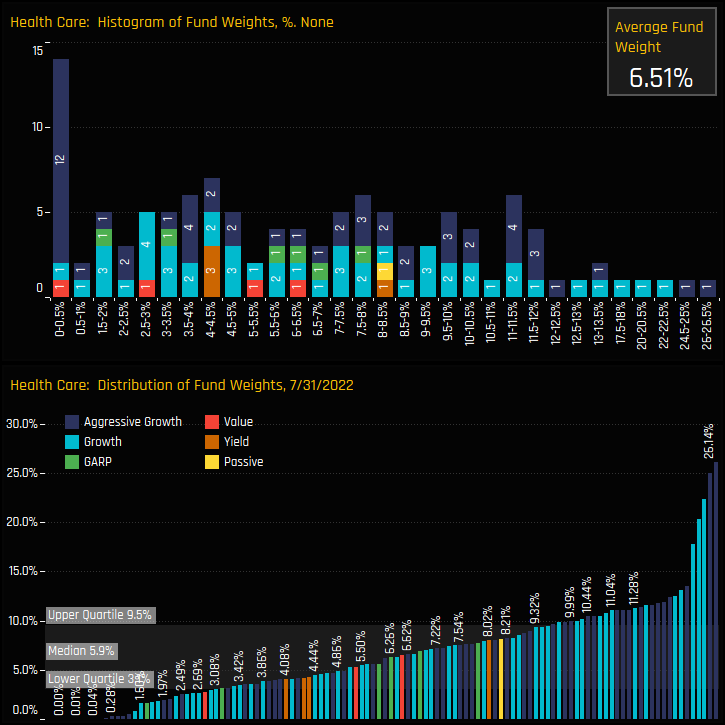

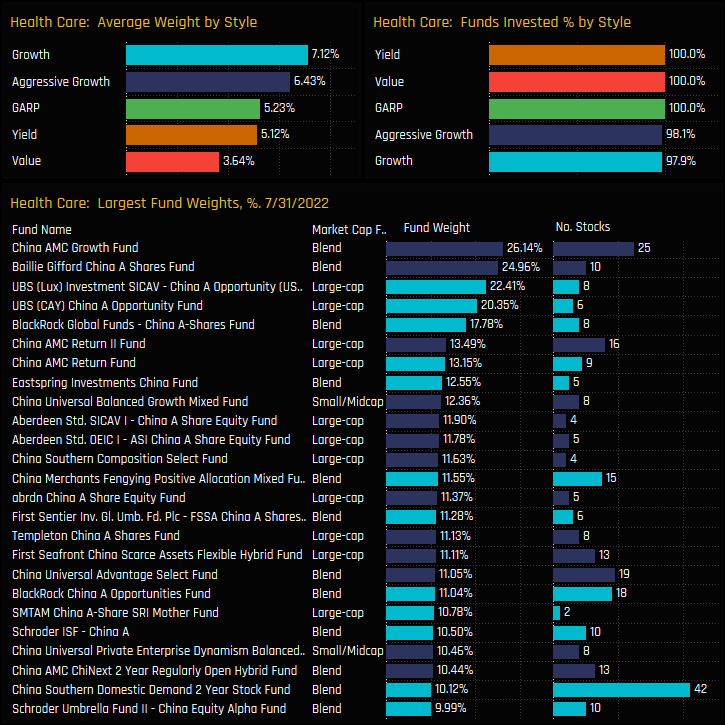

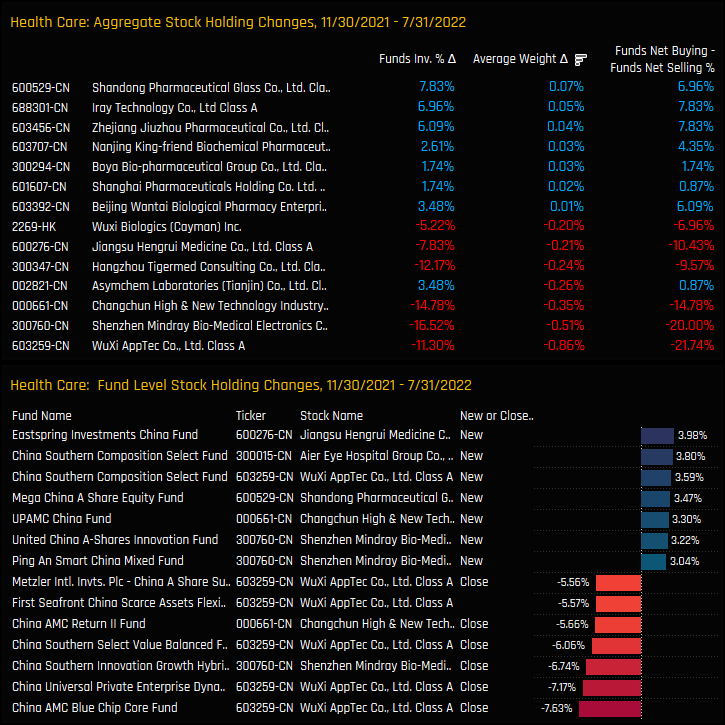

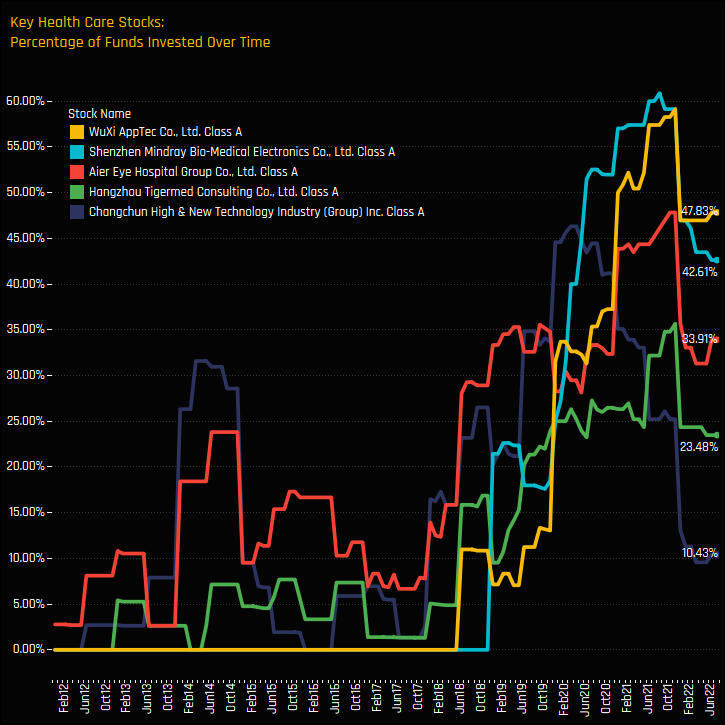

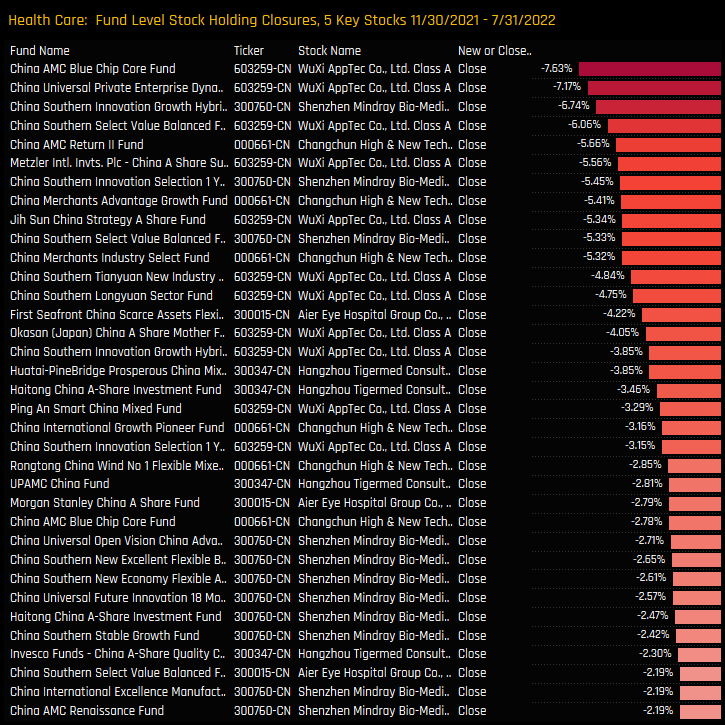

Health Care weights among China A-Share managers have fallen to some of the lowest levels on record, with managers moving from overweight to underweight over the last 12-months. The recent moves have been caused by a number of domestic A-Share funds closing out, or significantly cutting exposure to key stocks in the Health Care sector.

Time-Series & Sector Positioning

Fund Holdings & Style

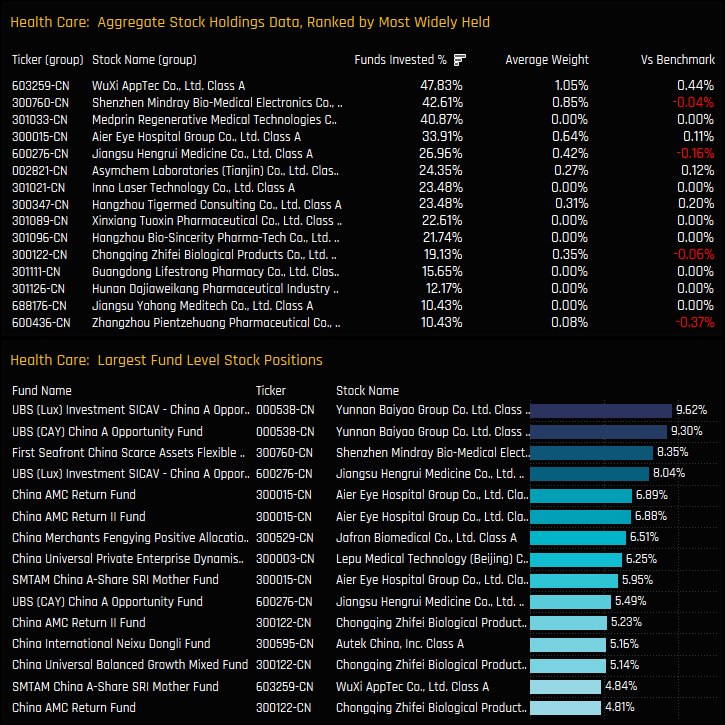

Stock Holdings & Activity

Key Stock Trends

Conclusions

China A-Share Health Care allocations have fallen aggressively over the last 2 years. The extent of the fall has relegated the Health Care sector to the 7th largest sector holding among active China A-Share managers, the lowest of the ‘gang of 7’ though still well above the fringe holdings of Real Estate, Utilities et al (see attachment for more details).

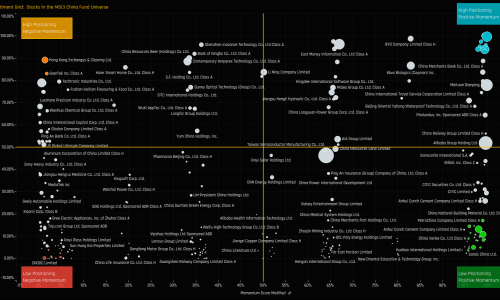

The decline has been driven in part by mass-closures from local China managers across some of the key names in the sector, led by WuXi AppTec Co and Shenzhen Mindray Bio-Medical Electronics. Both remain widely held and well owned by domestic and international funds alike, yet the severity of the declines raises questions as to why such a coordinated action occurred at all. The chart to the right shows the opening positions among those same domestic managers over the same period. It shows a preference for Industrials, Consumer and Technology stocks, but far more diversified than the closures on the Health Care side.

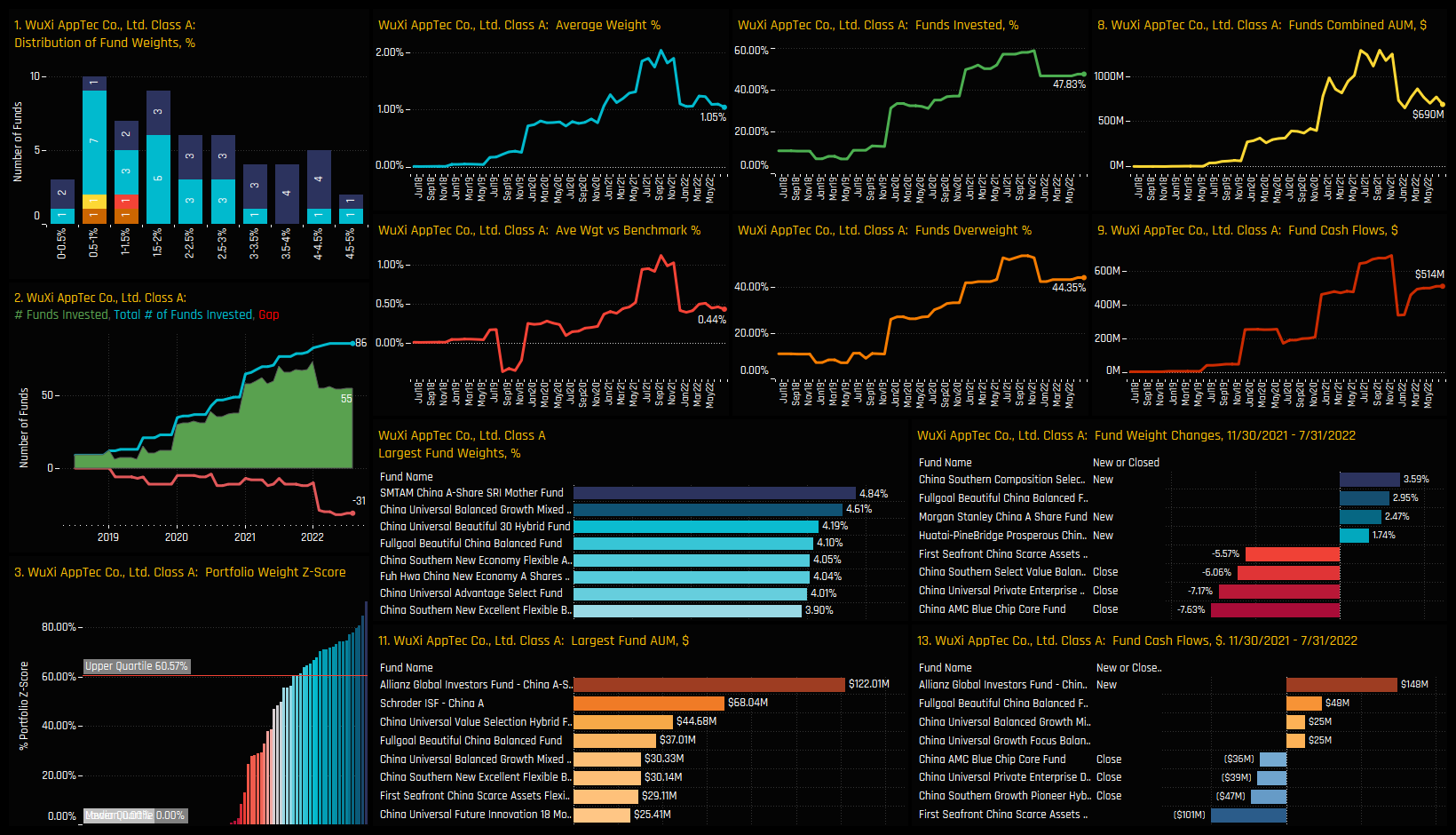

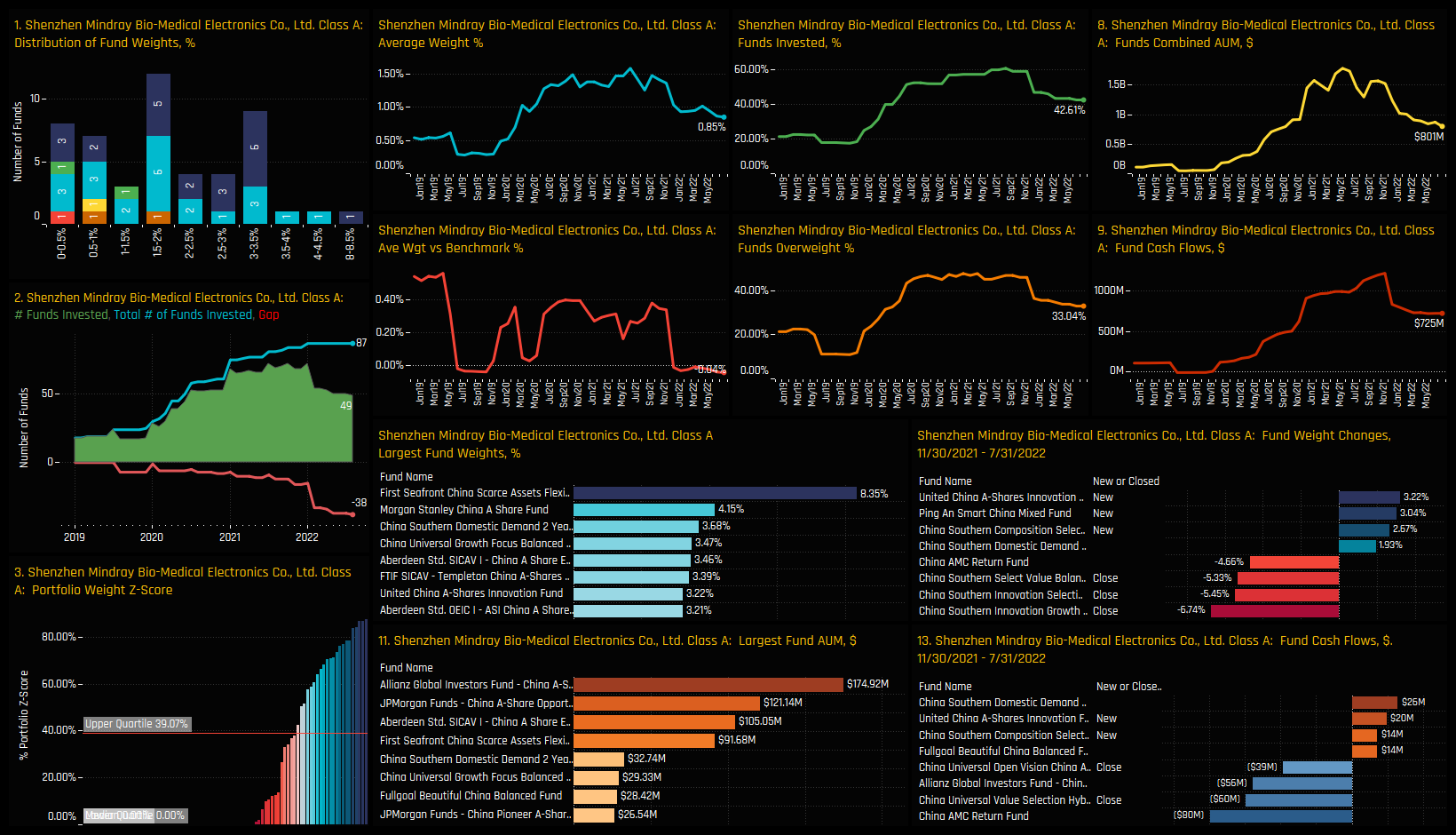

See below for more ownership information on WuXi AppTec Co and Shenzhen Mindray Bio-Medical Electronics. Please click on the link below for the extended report on Health Care exposure among active China A-Share funds.

Click on the link below for the latest data report on Health Care positioning among active China A-Share funds.

Stock Profile: WuXi AppTec Co

Stock Profile: Shenzhen Mindray Bio-Medical Electronics

For more analysis, data or information on active investor positioning in your market, please get in touch with me on steven.holden@copleyfundresearch.com

Related Posts

- Steve Holden

- March 13, 2025

Xi’s Champions: A Closer Look at Fund Positioning

Global, GEM, Asia Ex-Japan, China Active Equity Xi’s Champions: A Closer Look at Fund Pos ..

- Steve Holden

- October 25, 2023

China Fund Positioning Analysis, October 2023

150 Active MSCI China Funds, AUM $47bn China Fund Positioning Analysis, October 2023 In this is ..

- Steve Holden

- August 19, 2022

MSCI China Funds: Stock Sentiment Analysis

119 Active China Funds, AUM $52bn. MSCI China Stock Sentiment Investment levels among the thous ..