280 Active GEM Funds, AUM $325bn

Mexico

Mexican exposure among active EM investors continues to grind higher. Rotation among managers this year has moved Mexico to the largest country overweight in EM, with current levels of +1.22% above benchmark the highest on record. In this analysis, we look at the underlying fund holdings that make up this picture, and highlight 2 stocks that have been instrumental in Mexico's rise up the ranks. We also look to see if today’s levels of ownership look stretched compared to history, and whether Mexico can maintain this bullish ownership trend.

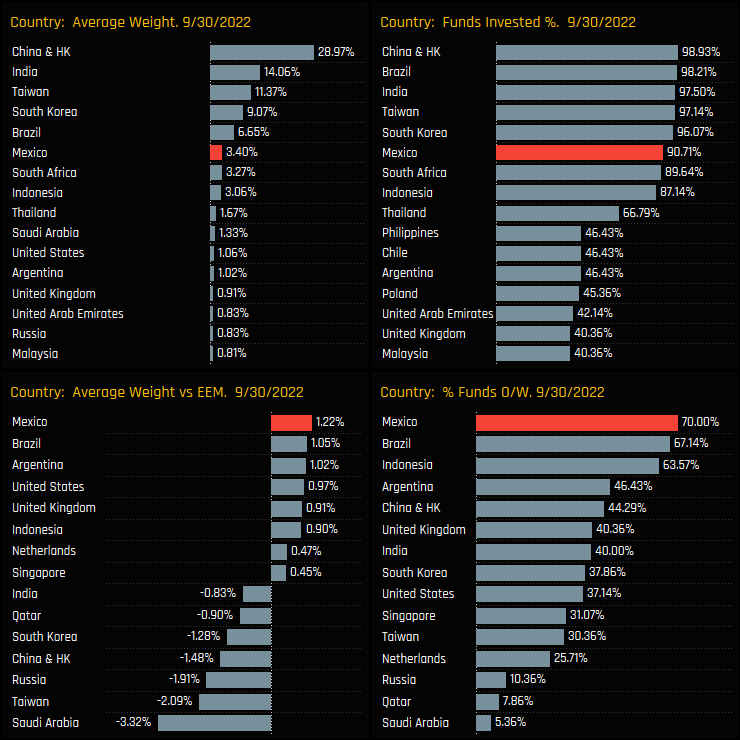

Ownership Trends and Country Positioning

Mexican allocations continue to surge higher among active EM managers. Average weights have risen to 3.40%, recovering from a 5-year bear market that bottomed out at 2.08% in late 2020. Perhaps the bigger story is that versus the benchmark iShares MSCI EM ETF, active GEM managers are at record overweights, with 70% of managers positioned overweight at a net +1.22% above benchmark.

Versus country peers, this places Mexico as the 6th largest country allocation, overtaking South Africa this month and at the top of the 2nd tier of nations after Brazil and the dominant Asian countries. Relative to benchmark, Mexico is now the largest country overweight position and 1 of only 3 nations that are held overweight by the majority of EM investors (the others being Brazil and Indonesia).

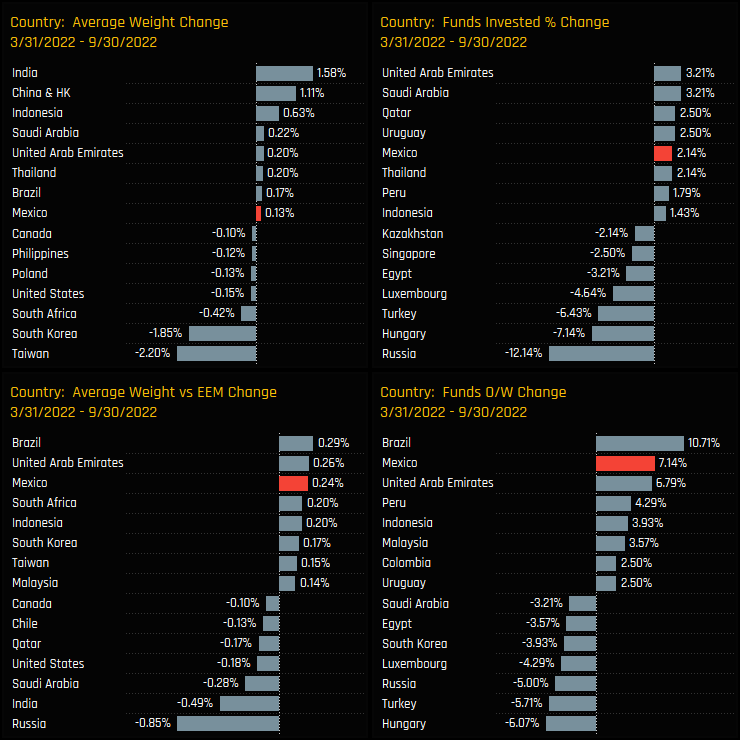

Country Activity & Sentiment

Over the past 6-months there has been some aggressive country repositioning among active EM managers. Mexico has been a beneficiary, with average weights increasing by +0.13%, a further +2.14% of funds opening exposure and +7.14% moving to overweight. Other beneficiaries include Brazil and some of the MENA nations, whilst funds scaled back on Taiwan, Russia, Turkey and South Korea.

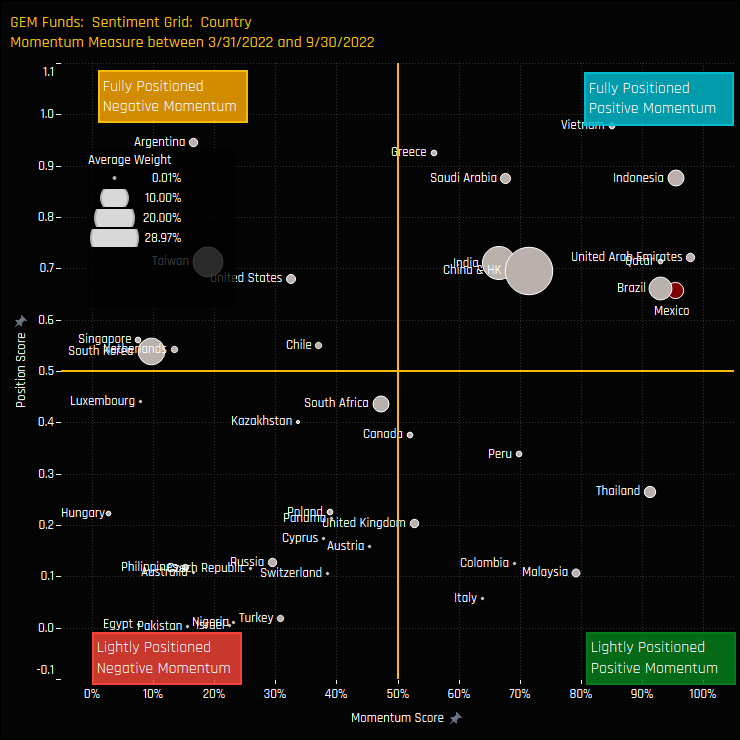

The chart below shows where current positioning in each country sits versus its own history going back to 2008 on a scale of 0-100% (y-axis), against a measure of fund activity for each country between 03/31/2022 and 09/30/2022 (x-axis). It highlights Mexico as a country seeing strong momentum, but still well below maximum allocations.

Fund Holdings

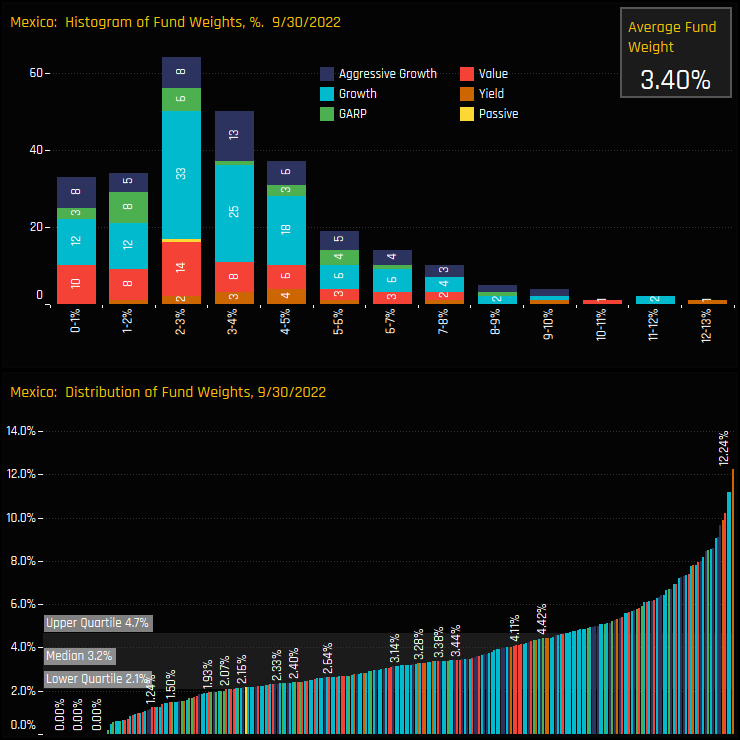

The charts below show the distribution of fund weights in Mexico among the EM funds in our analysis. The histogram in the top chart highlights a positively-skewed distribution that peaks between 2% and 5% and tops out at 12.24%. The bottom chart shows a median holding of 3.2%, with 50% of funds allocating between 2.1% and 4.7%.

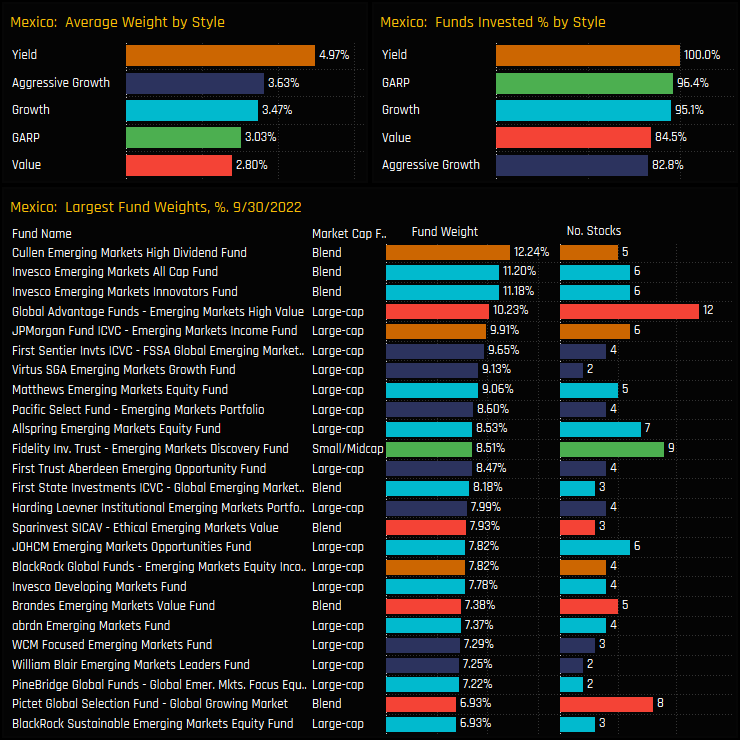

The top charts below show aggregate ownership levels in Mexico, split by Style. They highlight Mexico’s strong draw for Yield strategies, with every Yield fund in our analysis holding a position at an average weight of 4.97%. Indeed, Cullen Emerging Markets High Dividend Fund is the largest holder, though selected Growth and Aggressive Growth managers are also well allocated.

Fund Activity and Style Trends

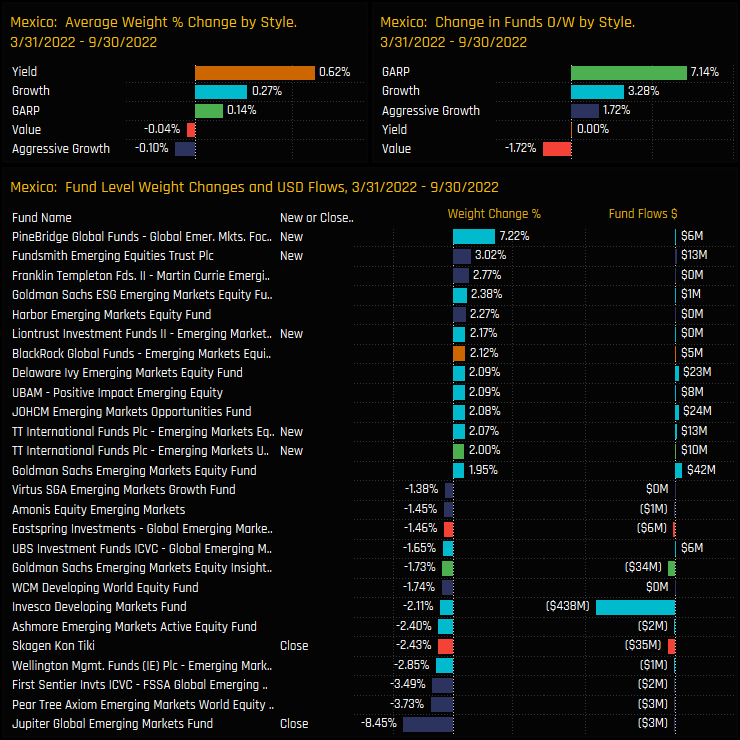

Fund level changes obviously reflect the aggregate increases in Mexican weights over the last 6-months. New positions from PineBridge Global EM Focus (+7.22%) and Fundsmith Emerging Equities (+3.02%) helped drive allocations higher. On a Style basis, Yield managers increased weights the most, though a higher percentage of GARP and Growth managers switched to overweight over the period

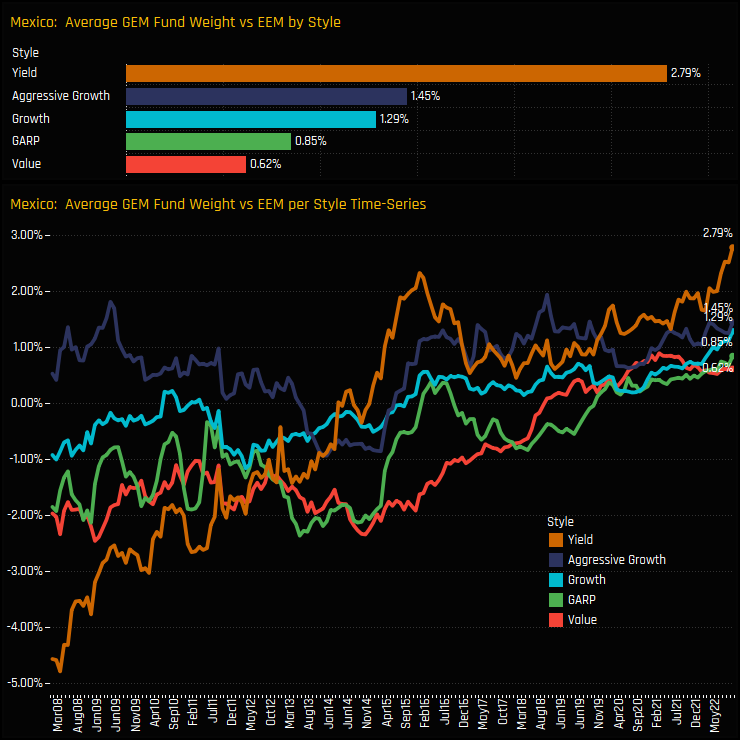

Over the longer-term, we can see the increased appeal of Mexico to Yield managers in the chart below, who ran a consistent underweight up until 2015 and have since gone on to record overweights. Value managers appear reluctant to follow other Style groups higher, though all remain overweight versus the iShares MSCI Emerging Markets ETF weight of 2.18%.

Stock Holdings & Activity

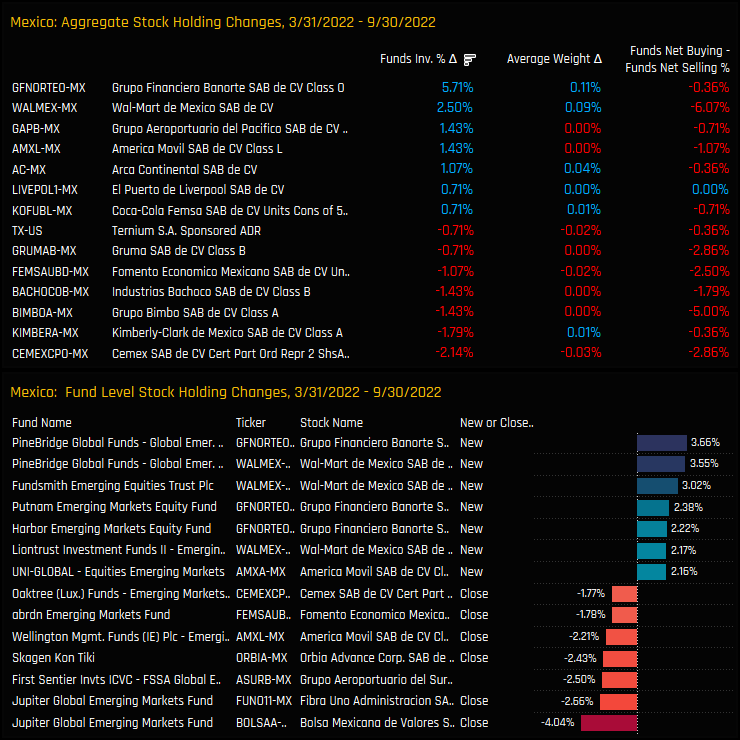

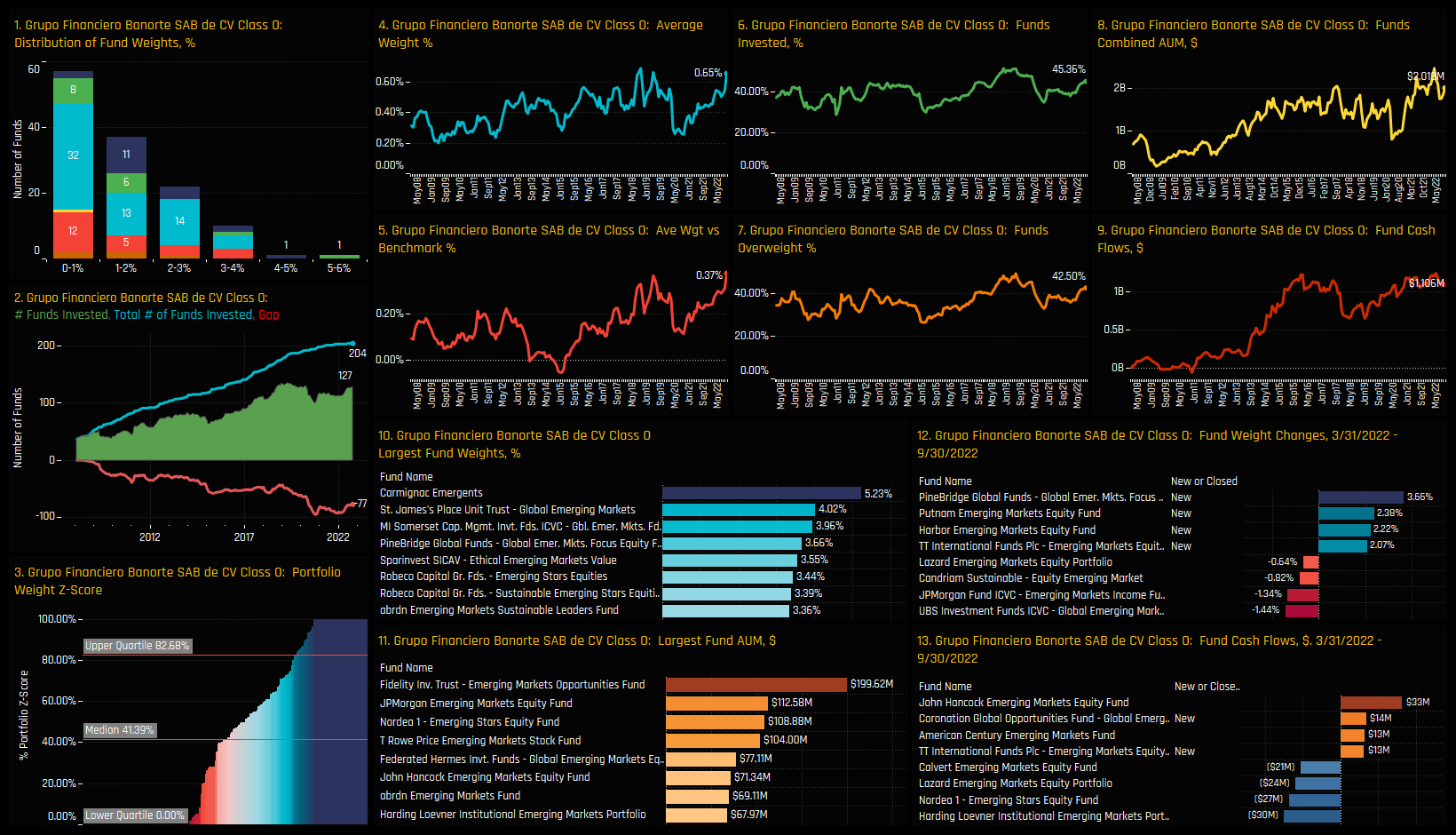

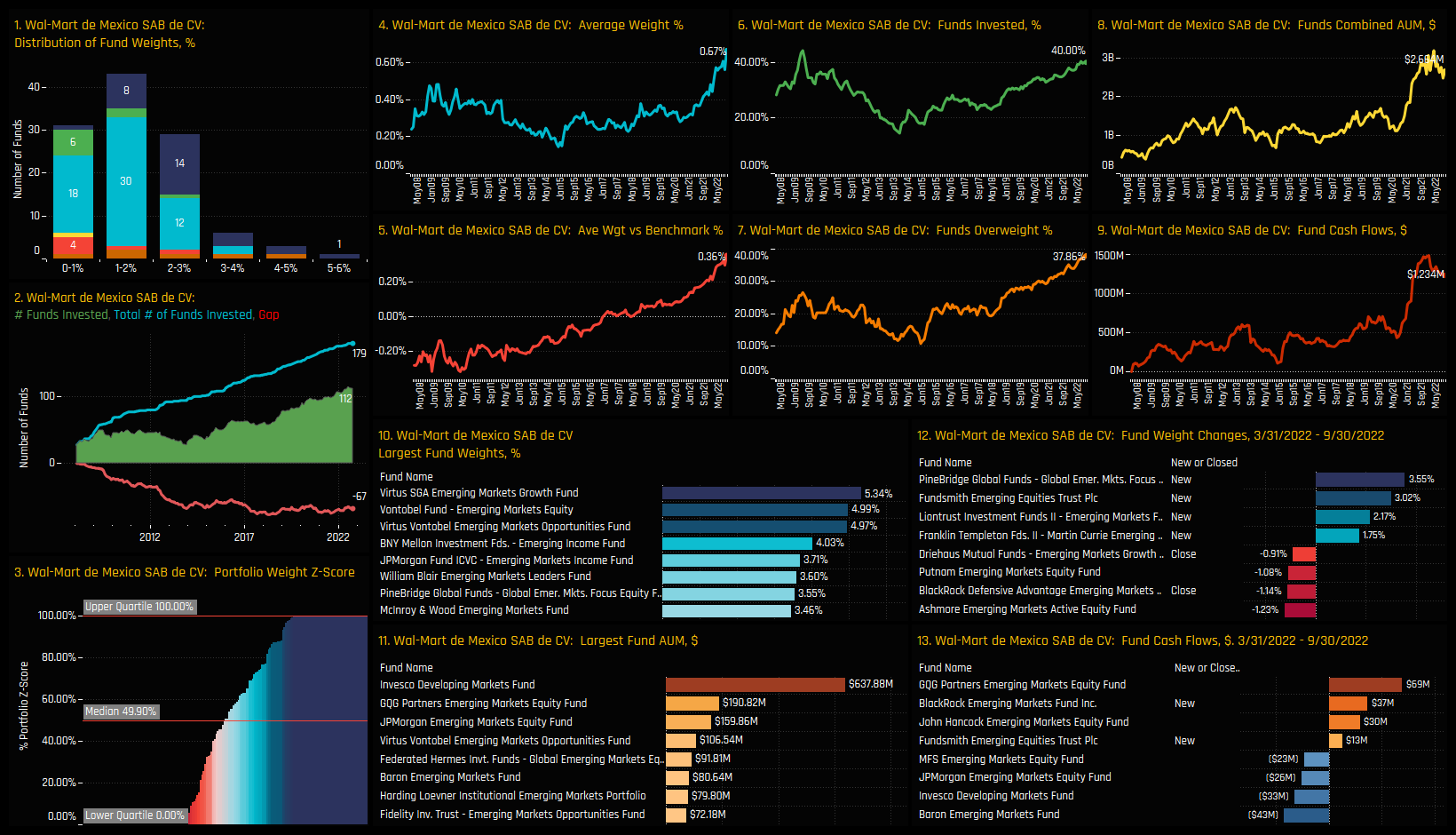

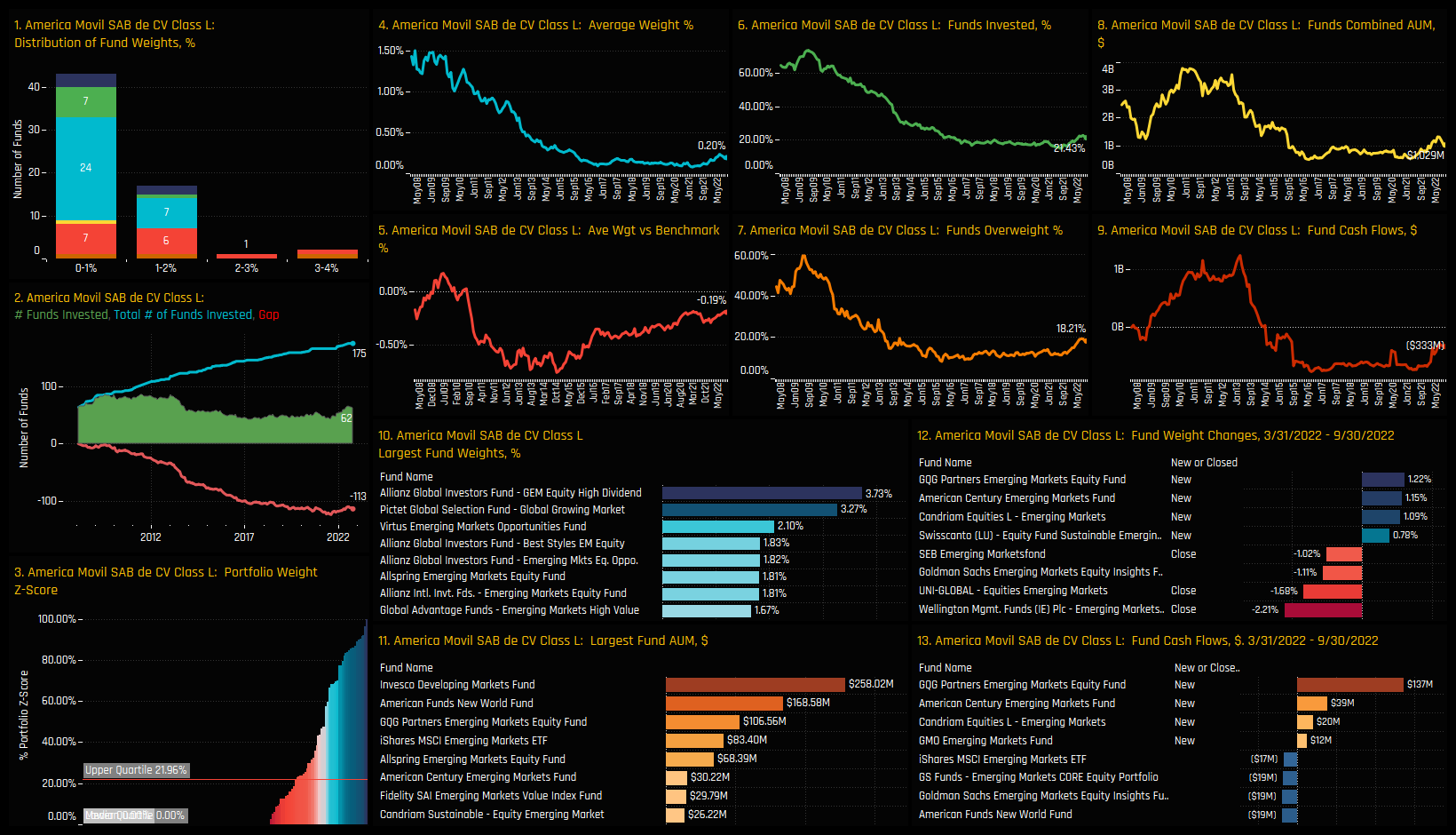

Aggregate stock holdings data is shown in the top chart below, and highlights the dominance of Grupo Financiero Banorte and Wal-Mart de Mexico among active EM managers. Both are held by over 40% of funds and both as key overweights compared to benchmark, on average. A further 7 stocks are held by more than 10% of funds, with the only decent sized net underweight that of America Movil SAB. Of the high conviction single fund holdings in the bottom chart, Fomento Economico Mexicano and Wal-Mart de Mexico stand out.

Conclusions

Mexican exposure among active EM investors continues to grind higher. It has been a key beneficiary of a rotation out of selected Asian technology stocks, and has been one of the countries that has plugged the void left by Russia’s exit from international markets.

On a stock level, Grupo Financiero Banorte and Wal-Mart de Mexico appear to offer investors high quality exposure to South America’s 2nd largest economy. Both stocks are widely held and have been instrumental in Mexico’s rise up the ranks over the past couple of years.

Despite this sentiment shift, allocations look far from stretched. As recently as 2015, Mexico commanded a weight close to 5% on average among active EM funds. The chart to the right shows the Z-Score of Mexican portfolio weights for every fund in our EM analysis since 2008. A score of 100% would indicate today’s weight is the highest on record for that fund, and 0% the lowest. Three quarters of EM funds have a Z-score less than 64.7%, and half less than 37.9%. In the minds of investors, Mexico can certainly command a higher allocation from here.

Please scroll down for a link to the full ownership report for Mexico and profiles of the key stocks mentioned in the analysis.

Click on the link below for the full data report on Mexico positioning among active GEM funds.

Grupo Financiero Banorte

Wal-Mart de Mexico

America Movil

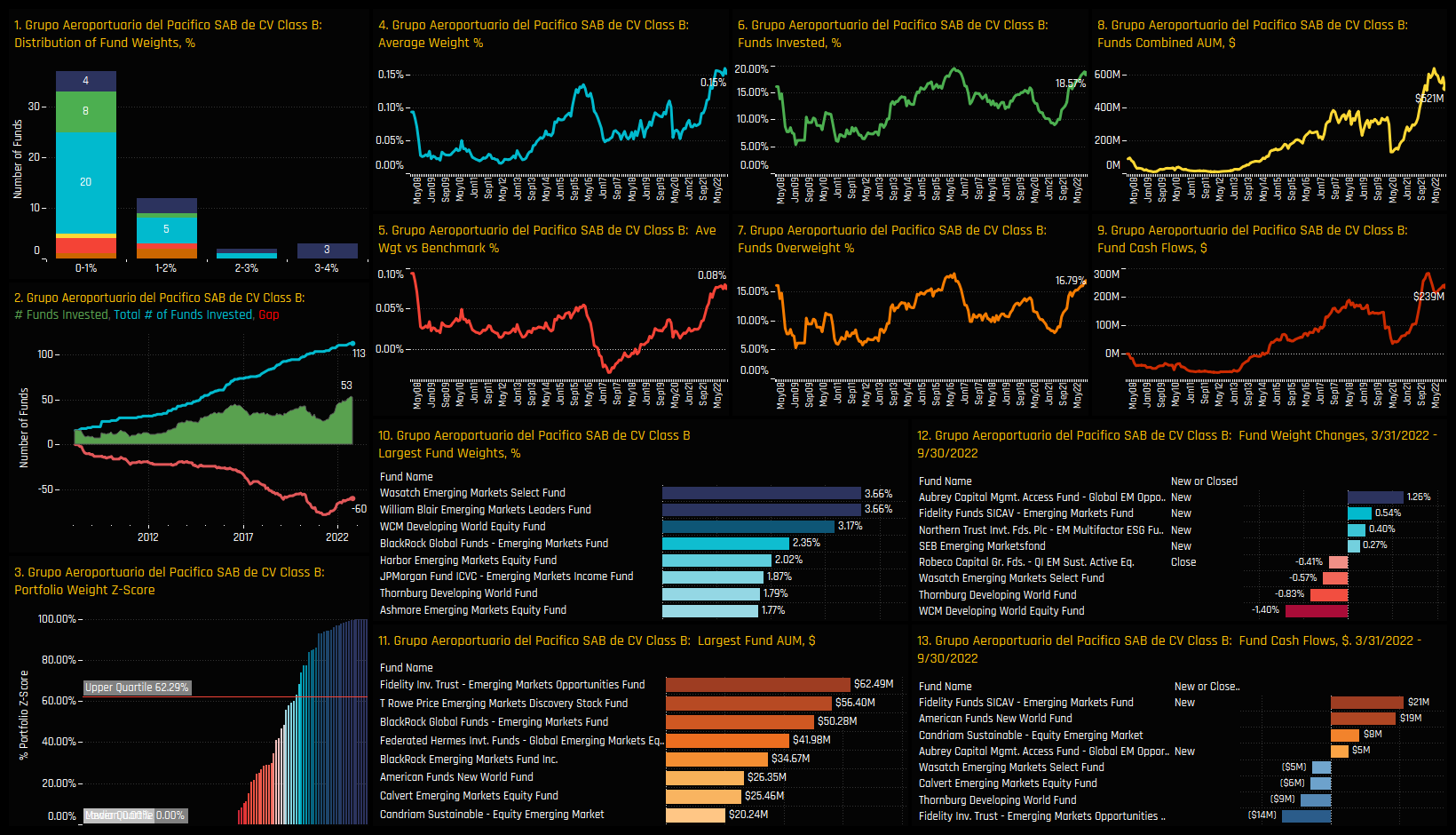

Grupo Aeroportuario del Pacifico

For more analysis, data or information on active investor positioning in your market, please get in touch with me on steven.holden@copleyfundresearch.com

Related Posts

- Steve Holden

- October 13, 2024

GEM Funds: Performance & Attribution Review, Q3 2024

352 Global Emerging markets active equity funds, AUM $429bn GEM Funds: Performance & Attri ..

- Steve Holden

- October 24, 2024

Emerging Markets Ex-China Insights, October 2024

30 EM Ex-China Funds, AUM $1.7bn Active EM Ex-China Funds: Positioning Insights, October 2024 H ..

- Steve Holden

- January 27, 2025

GEM Funds: Positioning Chart Pack, Jan 2025

348 emerging market Funds, AUM $418bn Active GEM Funds: Positioning Chart Pack, Jan 25 Headline ..