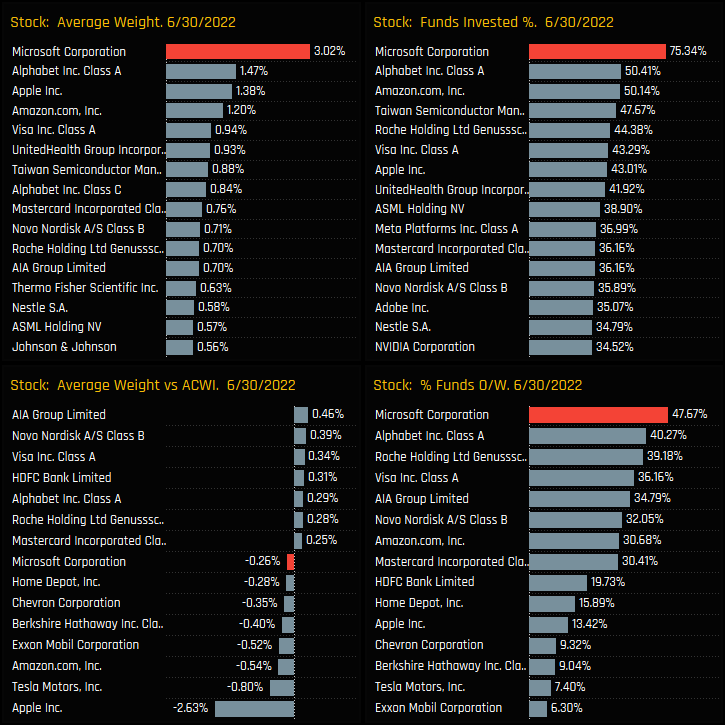

365 Active Global Funds, AUM $906bn

Microsoft Corp (MSFT)

Microsoft Corporation is the most widely held stock among active US equity investors. Of the 365 active strategies in our analysis, 75% own Microsoft at an average weight of 3.02%. There is a growing dispersion between Value and Growth managers in MSFT. Growth managers are at record levels of ownership, whereas Value managers are running their largest underweight on record. US Growth managers are relying on Microsoft to deliver an increasing proportion of the Growth within their portfolios. The cost of that growth is coming under scrutiny by Value managers

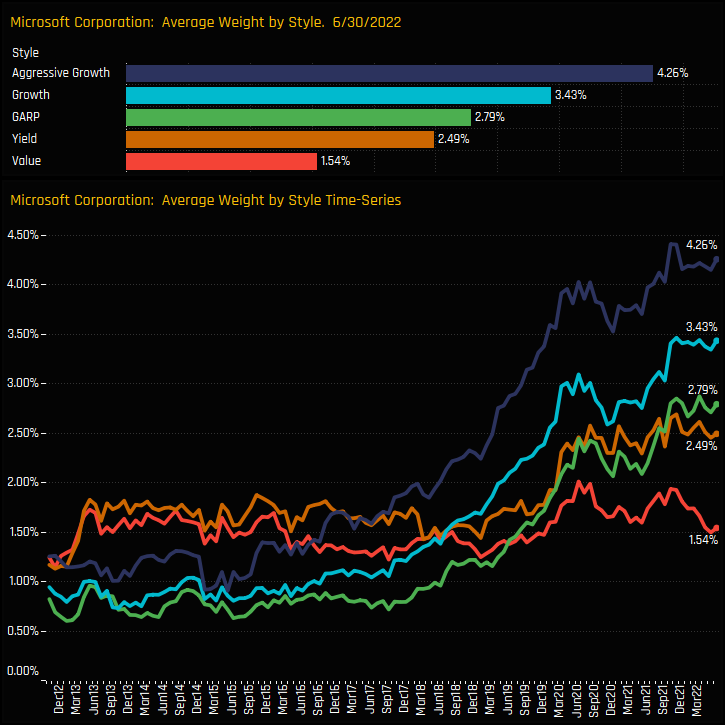

MSFT Positioning

Over time, absolute ownership levels in Microsoft, shown in the left hand charts really gathered pace between early 2018 and late 2020. Average weights broke out of a sub 1.5% range and proceeded to double, commensurate with a rise in the percentage of funds invested from sub 60% to a peak of 77% in February 2021. Versus the benchmark, US investors switched to underweight in 2016 despite rising ownership, with weights in benchmark indices outpacing those of the active managers in our analysis.

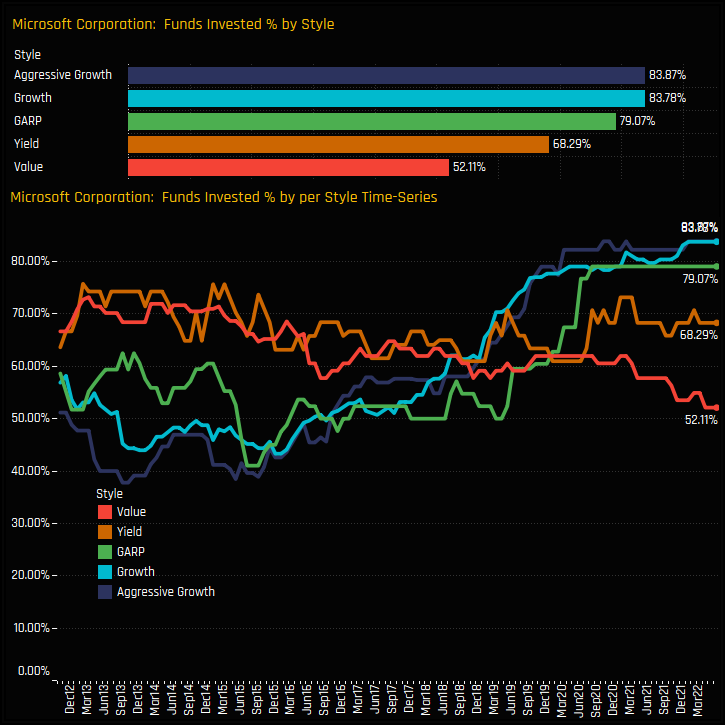

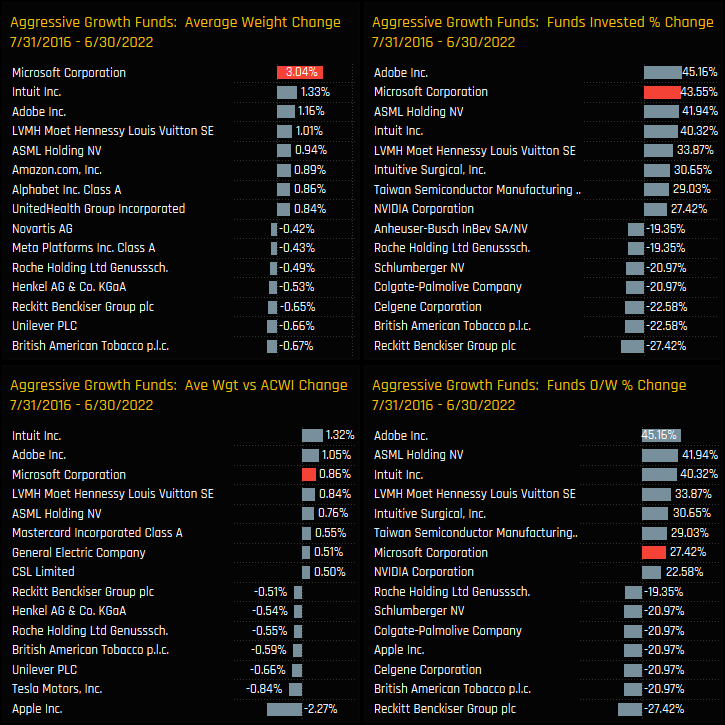

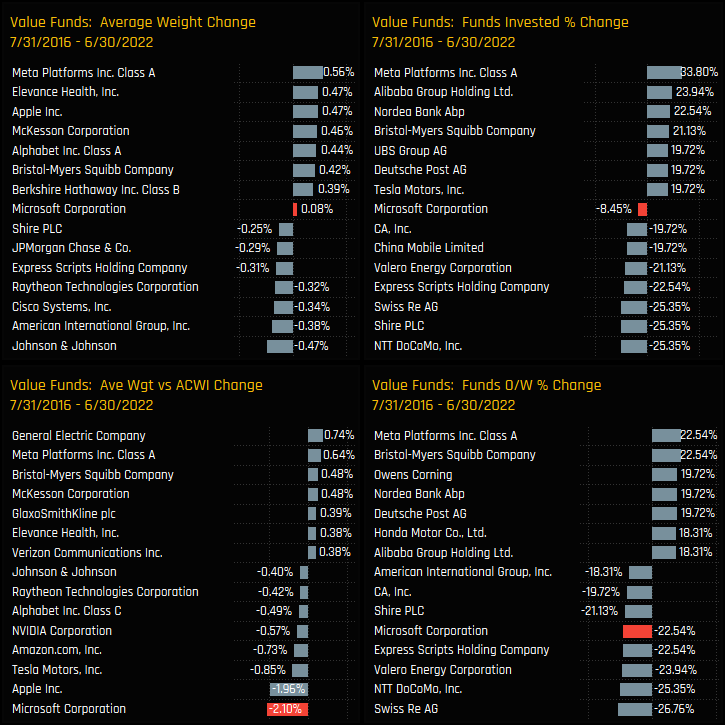

Style Trends

Style Dispersion

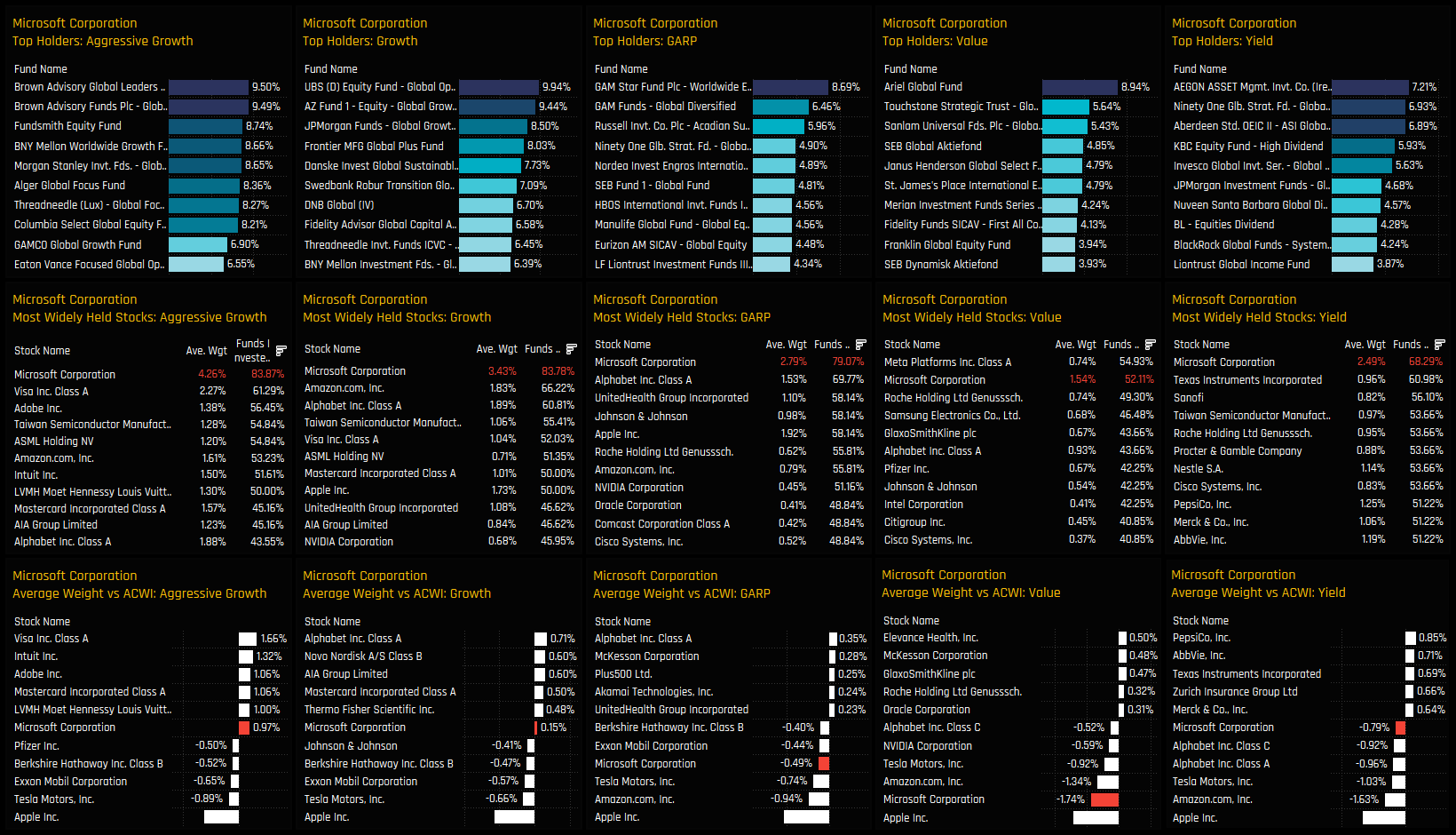

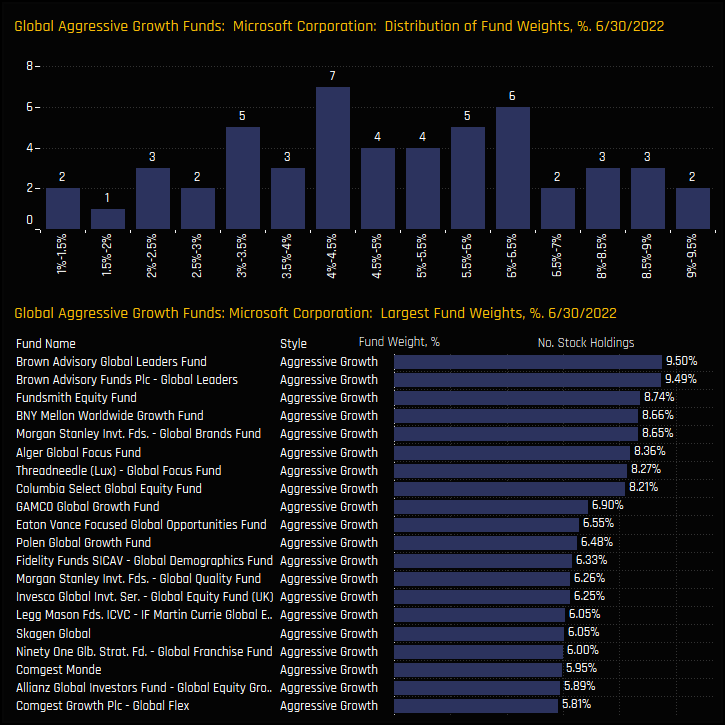

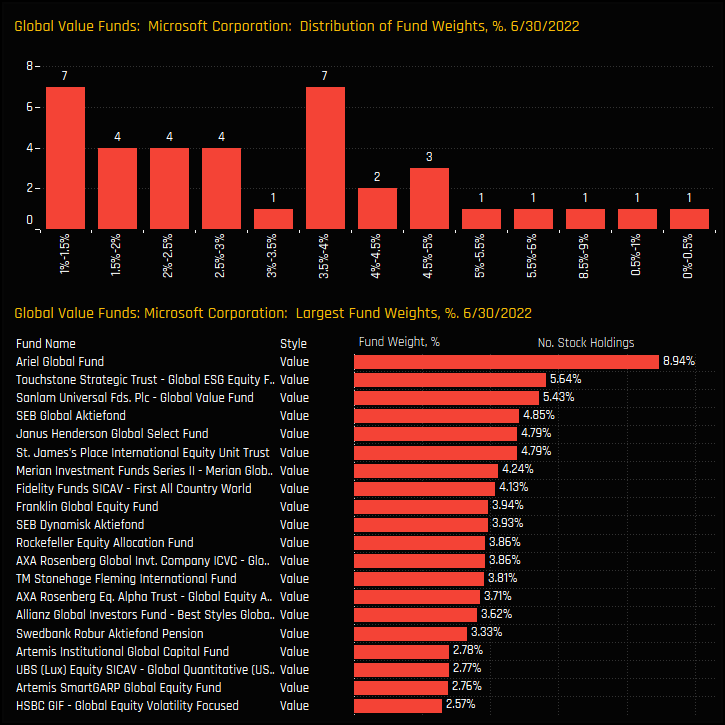

Microsoft Holdings by Style

Growth vs Value

The Style Rebalance

Click on the link below for the latest data report on Microsoft Corp positioning among active Global funds.

For more analysis, data or information on active investor positioning in your market, please get in touch with me on steven.holden@copleyfundresearch.com

Related Posts

- Steve Holden

- March 26, 2025

Global Funds: Positioning Chart Pack, March 2025

334 Global Equity Funds, AUM $1.2tr Active Global Funds: Positioning Chart Pack, March25 Inside ..

- Steve Holden

- March 13, 2025

Xi’s Champions: A Closer Look at Fund Positioning

Global, GEM, Asia Ex-Japan, China Active Equity Xi’s Champions: A Closer Look at Fund Pos ..

- Steve Holden

- June 30, 2023

Global Fund Positioning Analysis, June 2023

350 Global Equity Funds, AUM $940bn Global Fund Positioning Analysis, June 2023 Japan: Early Si ..